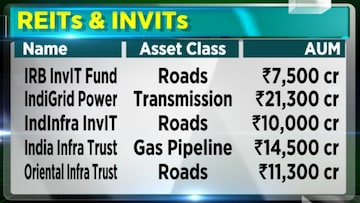

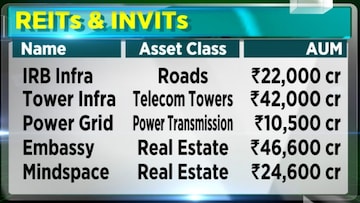

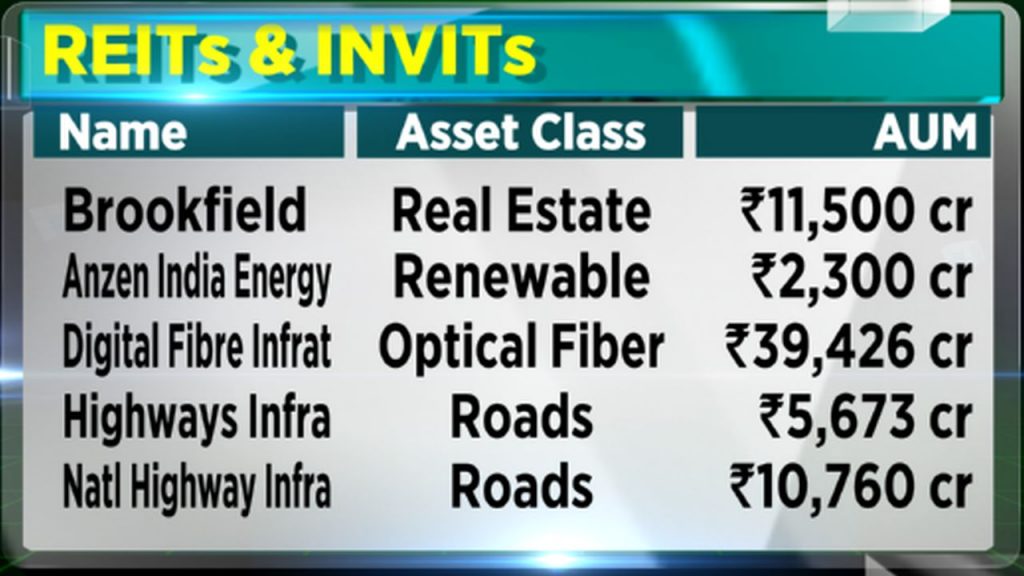

Real estate investment trusts (REITs) and Infrastructure Investment Trust (InvITs) have, over the last few years, evolved in the country as an important asset class. Budget proposal, however, throws some uncertainty in this particular space regarding the returns for the investors which is so critical.

Budget proposal is to bring under its tax net, the income distributed by REITs and InvITs in the form of debt repayment.

Embassy REIT, CEO, Vikaash Khdloya spoke with CNBC-TV18 about the impact of taxes on yield for unit holders. According to Khdloya, the tax impact on yield will range from 50-100 basis points. The CEO also explained that 40 percent of the total cash distribution to unit holders is in the form of debt repayment, which is currently considered an income under dual non-taxation.

“The current proposal to tax the debt repayment component impacts the distribution yield by around 50-100 basis points (bps),” he said.

Khdloya acknowledged the adverse impact this tax would have on investors and stated that the company will make a suitable representation to the Ministry of Finance. The repayment of debt is a significant source of income for unit holders, and its taxation would affect their returns negatively.

Ajay Rotti, Partner at Dhruva Advisors, Adarsh Ranka, Partner at EY and Gopal Agrawal, Investment Banker at Edelweiss Financial Services also shared their insights.

For the entire discussion, watch the accompanying video