‘Don’t expect much from a vote on account’ that’s the popular sentiment and sense in tax circles ahead of Budget 2024. While the rationale is perfectly justified given the upcoming general election, the wealth and personal finance eco-system can’t help hoping that given this is an election budget, the Finance Minister will make some tweaks to put more money in the hands of the aspirational Indian middle class.

Topping the wishlist is the hope that there will be some tweaks to sweeten both the old and the new (concessional) tax regimes.

There is also the long standing expectation of increasing the popular ₹1.5 lakh deduction offered under Section 80C in the old regime given that this limit was last raised almost a decade ago.

Then there is the often-repeated demand of increasing the deductions offered on medical insurance (Sec 80 D) as well as ₹2 lakh deduction on interest paid towards a housing loan (Section 24).

Tax experts feel these limits need to be hiked to bring them more in sync with today’s inflation adjusted reality.

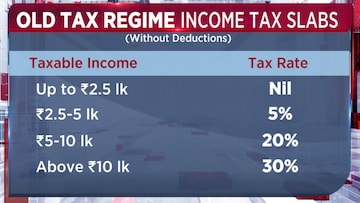

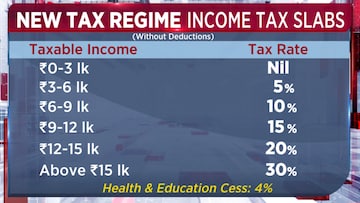

Current personal income tax rates

Old tax regime (With exemptions)

New (default) tax regime

The capital gains conundrum

While any sort of relief on tax rates or higher/more deductions will be welcome, the biggest ask from a direct taxation standpoint is a streamlining and rationalising of the capital gains tax regime.

Tax experts and wealth managers agree that the present multiple definitions of ‘long-term’ and ‘short-term’ as well as a plethora of rates across numerous asset classes makes India’s capital gains regime extremely complex and cumbersome from an investors’ stand point.

For example when it comes to listed equity shares, long term is defined as 1 year with a 10% tax on gains above ₹1 lakh. On the other hand, for unlisted shares the definition of long term is 2 years while the rate of tax is 20%.

Then there is the issue of indexation – while some asset classes offer the benefit of indexation on taxing long term holdings, others don’t.

That also brings us to the issue of debt mutual funds.

Budget 2023 dealt a body blow to debt funds by removing the indexation benefit on long term capital gains arising funds which predominantly invest in the fixed income market.

The mutual fund industry is hoping that there will be some re-think on this given that tax efficiency over fixed deposits was a big reason why retail investors had started investing in the debt market via MFs.

Industry body CII has urged the FM to consider a clear classification where capital market financial assets like equity MFs, debt MFs, bonds etc will have a common clear definition of long term i.e 12 months with a 10% long term tax and a 15% short term capital gains tax for holdings below 1 year.

CII proposed cap gains framework

Coming to industry’s wishlist from the finance minister, corporates are hoping that the time period by which a company needs to be set up operations to enjoy the concessional tax rate of 15% will be extended from the current deadline of March 2024 by at least 1 year.

Directional clarity on ‘Global Minimum Tax’

Tax experts are hoping that the Finance Minister gives directional clarity with respect to India joining the global ‘Base Erosion Profit Shifting’ or BEPS framework.

‘Pillar two’ of BEPS, which is a global tax system, deals with levying a minimum tax of 15% on MNCs in all jurisdictions in which they operate and earn profits.

Over 40 countries have already put this framework in motion and India is expected to follow suit, paving the way for India to collect more tax revenue from Indian multi national companies as well as global MNCs operating in India.

TDS reforms

Another key tax direct tax reform that industry is looking for is simplification of TDS provisions. Currently 31 different sections of the income tax act deal with tax on various types of payments with TDS rates ranging from 0.1 percent to 30%.

The tax fraternity is looking for a simplification and rationalisation of these multiple rates.

Many of the key tax asks or wish list pointers are in the nature of structural, long term reforms.

Industry hopes that while the government many not be able to act on them in the interim budget, it will give a signal to indicate that tax policy will eventually move to address some of these most critical issues.

(Edited by : Anshul)

First Published: Jan 30, 2024 2:35 PM IST