Budget 2023 introduced several changes to the 'new income tax slab'. As part of this, the tax rebate has been extended on income up to Rs 7 lakh as per Section 87A, as against Rs 5 lakh. The basic exemption limit has been raised to Rs 3 lakh from Rs 2.5 lakh. However, the old income tax slabs regime has not been abolished. Given that, taxpayers still have the option between the two regimes when paying their taxes. But which one is better — the old tax regime or the new one with the proposed changes?

Live TV

Loading...

CNBC-TV18 spoke to experts to analyse the situation.

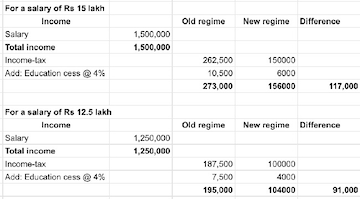

According to the calculation provided by Clear, for a salary of Rs 15 lakh, which will have an education cess of 4 percent, the income tax amount is lower at Rs 1.56 lakh in the new regime, while it is at Rs 2.73 lakh in the old regime.

For a salary of Rs 12.5 lakh, the tax under the new regime will be Rs 1.04 lakh, and it will be Rs 1.95 lakh under the old regime.

(Source: Clear)

In these cases, the taxpayer saves more taxes under the new tax regime. However, it must be noted that this would be without any deductions, barring standard deduction, which has now been added. Also, the situation may vary from person to person.

Sandeep Sehgal, Partner- Tax at AKM Global, said that people availing deductions like HRA, interest on a home loan, tuition fee of children, insurance, mediclaim etc., would need to evaluate as in their case.

The old regime may still prove more tax efficient for some of them.

Put simply, taxpayers now need to calculate and see if they still need to be in the old regime.

According to Adhil Shetty, CEO and Bankbazaar, the new regime is going to be the way forward as the default option. The old regime, with its brackets frozen in 2013, may not be enhanced anytime soon and hence is becoming increasingly tougher to stick to.

"Taxpayers can use an online tax calculator to understand which regime serves them the best," he said.

Shetty thinks that 'real' rates of the old tax slab are too high when adjusted for inflation, with the 30 percent slab essentially acting like a 40 percent one without bracket enhancements.

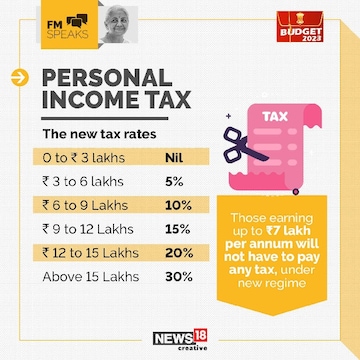

The new proposed changes to the new tax slab

As per the revision, an individual with an annual income up to Rs 3 lakh will not have to pay any tax (as against an earlier limit of Rs 2.5 lakh). Further, it has proposed a 5 percent tax for income between Rs 3 – 6 lakh, 10 percent for income between Rs 6-9 lakh, 15 percent for income between Rs 9-12 lakh, 20 percent for income between Rs 12 – 15 lakh and 30 percent above Rs 15 lakh.

It must be noted that a tax rebate can be availed now on income up to Rs 7 lakh. On number terms, this could come up to for salaries up to 7.5 lakh. A standard deduction of 50,000 is now available and the rebate limit has been increased to Rs 7 lakh from 5 lakh.

What is the old tax slab?

According to the old tax regime, if the total income of an individual is not more than Rs 2.5 lakh, the tax rate is nil. If the income falls in Rs 2.5 lakh-Rs 5 lakh bracket, 5 percent income tax is payable. However, those earning up to Rs 5 lakh can claim a rebate of Rs 12,500 under Section 87A of the Income Tax (I-T) Act.

For individuals earning Rs 5 lakh to Rs 10 lakh, tax is deducted at the rate of 20 percent. If the total income of an individual is more than Rs 10 lakh, 30 percent tax is payable.

First Published: Feb 1, 2023 7:14 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM

Election Commission registers case against BJP's Tejasvi Surya for alleged violation of poll code

Apr 26, 2024 5:08 PM