Equity Linked Saving Scheme (ELSS), a tax-saving mutual fund, is likely to lose its sheen under the 'new income tax slab' after Budget 2023 changes, analysts believe. This is because most new taxpayers may opt for the new regime for Income Tax return filing now as it may allow them to pay taxes easily, without much planning.

Live TV

Loading...

Also, with the proposed amendments announced in the Budget --the 'new Income Tax slab'-- is expected to get attractive for many, analysts say.

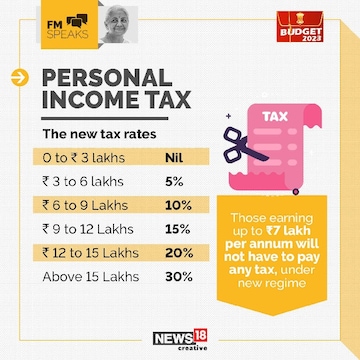

Union Finance Minister, while making the Budget announcements, introduced a slew of changes to the 'new income tax slab' in order to reduce the tax liabilities for middle class individuals. Under this, tax rebate has been extended on income up to Rs 7 lakh as per Section 87A, as against Rs 5 lakh. Also, the government revamped the tax slabs.

Consequently, many taxpayers would now move to the 'new tax regime and under this, the investors will have to forego all the deductions that were applicable in the old one. In the old structure, investors can save tax by investing up to Rs 1.5 lakh in schemes such as ELSS under Section 80C of the Income Tax Act.

ELSS is an open-ended equity-linked saving scheme that comes with a statutory lock-in of three years. The growth of the ELSS category has been slowing for the past few years and with a push toward the new regime, the growth of the ELSS category would be further challenged. Even last-minute tax savers are likely to opt for the new regime if they run out of time.

Experts say that the changes to 'new tax slab' will lead to a saving of Rs 33,800 for those earning up to Rs 7 lakh annually. Those with income up to Rs 10 lakh would save Rs 23,400 and Rs 49,400 saving would accrue to those earning up to Rs 15 lakh.

For high salary people, Sitharaman also reduced surcharge from 37 percent to 25 percent for high net worth individuals with income above Rs 2 crore. This would translate into a saving of around Rs 20 lakh for those having a salary income of about Rs 5.5 crore.

Despite these, it must be understood that ELSS is a decent investment avenue and one must continue with it. After all, the rule says that investing solely to avoid taxes is not a good strategy. It must be done for creating long-term corpus.

ELSS provides the benefit of diversified equity investments that allows one to earn better returns. In this, investments are done in a wide array of companies across market capitalization, keeping in mind the long-term growth of companies. Like any other equity scheme, they have the capability of generating efficient returns if the scheme performs well (in the long term), experts opine.

It is advisable to follow the Systematic Investment Plan (SIP) route while investing in ELSS since it is a more disciplined approach. Starting early also gives the advantage of using SIP which reduces the cash outflow burden that an investor would otherwise face when doing a last-minute investment.

In case of lump sum investments, investing at opportune market falls should be considered rather than impulsive investments, experts say.

(Edited by : C H Unnikrishnan)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 8% voter turnout recorded by 9 am

Apr 26, 2024 9:11 AM