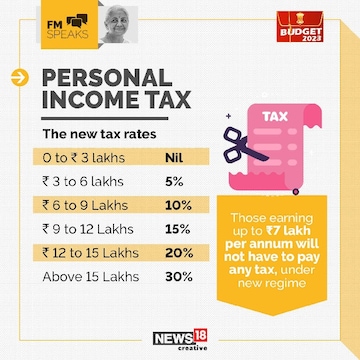

Budget 2023 proposed major changes on personal income tax front. While making announcements, Union Minister Nirmala Sitharaman said that the 'new tax regime' will become a default one. She further extended tax rebate on income up to Rs 7 lakh in new tax regime as per Section 87A, as against Rs 5 lakh. This move is aimed at incentivising people to shift to the new tax regime, which has not seen much traction since launch in FY21.

Live TV

Loading...

Understanding the scenario

The 'new tax regime', which was originally introduced in Budget 2022, could not attract many taxpayers. Successive reports have revealed a significantly higher preference for the old tax regime.

ALSO READ | Budget 2023 | No capital gains if you convert physical gold to digital gold — How will you benefit?

.@SurabhiUpadhyay & @sonalbhutra present a quick breakdown of the changes introduced in personal income tax in Budget 2023 https://t.co/fk3H1bcze7

— CNBC-TV18 (@CNBCTV18News) February 1, 2023

In a conversation with CNBC-TV18, Himanshu Parekh, Partner and Head of Tax (West) at KPMG said out of 7 crore income tax return filers, less than 5 lakh tax savers opted for the new regime in financial year 2021-22.

Few taxpayers, especially those in the higher tax brackets, opted for the new tax regime.

ALSO READ | Budget 2023 | Tax rebate limit raised to Rs 7 lakh under new regime — Check proposed tax slabs here

The reason behind

"This is because many exemptions and deductions are not allowed in the new regime. All common deductions like interest on housing loan, exemption for HRA and LTA, deduction for life insurance, medical insurance are not available," said Naveen Wadhwa, DGM at Taxmann.

For any person with financial and family responsibilities, it is difficult to let go of deductions to opt for the new tax regime. Therefore, they remained on the old regime to claim necessary deductions.

Deductions for provident fund, insurance payments, rent or home loan EMIs, or children’s school tuition fees are common. Anyone with a home loan especially cannot afford to lose its massive tax benefits, Bankbazaar said in a note.

The changes

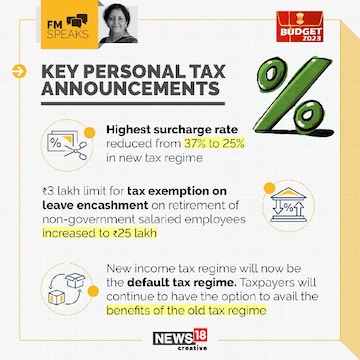

Budget 2023 has announced tax rebate for those with annual income of up to Rs 7 lakh under the new tax regime but made no changes for those who continue in the old regime. Another push for salaried class taxpayer to switch to new tax regime is the introduction of standard deduction of Rs 50,000 under the new regime.

The old tax regime provides for a similar deduction and no tax on income up to Rs 5 lakh only.

Also, the basic exemption limit has been raised to Rs 3 lakh from Rs 2.5 lakh. A Rs 2.5 lakh basic exemption limit is prescribed in old tax regime.

Experts say that the move will lead to a saving of Rs 33,800 for those earning up to Rs 7 lakh annually and opting for new tax regime. Those with income up to Rs 10 lakh would save Rs 23,400 and Rs 49,400 saving would accrue to those earning up to Rs 15 lakh.

For high salary people, Sitharaman also reduced surcharge from 37 percent to 25 percent for high net worth individuals with income above Rs 2 crore. This would translate into a saving of around Rs 20 lakh for those having a salary income of about Rs 5.5 crore.

First Published: Feb 1, 2023 4:47 PM IST

PPF is a retirement-focused investment instrument attracts investors because of its Exempt-Exempt-Exempt (EEE) tax status. The maturity amount and the overall interest earned during the investment period are tax-free.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election Phase 2: Experts decode the key trends and issues in key battleground states

Apr 26, 2024 11:53 PM

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM