Finance minister Nirmala Sitharaman has revised the income tax slab in the Union Budget 2020. In the Budget announcement, Nirmala Sitharaman proposed to bring a simplified personalised income tax scheme for those who forego deductions.

"The new tax regime will be optional and the taxpayers will be given the choice to either remain in the old regime with exemptions and deductions or opt for the new reduced tax rate without those exemptions," Sitharaman said while unveiling Budget.

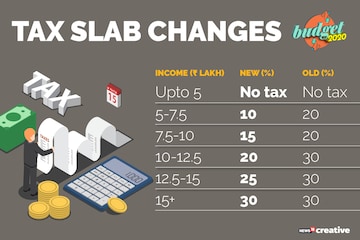

According to the proposal, if the total income of an individual falls in the bracket of Rs 5 lakh- Rs 7.5 lakh, 10 percent tax will be payable. For individuals earning Rs 7.5 lakh to Rs 10 lakh, tax will be deducted at the rate of 15 percent, against the existing 20 percent.

For individuals earning between Rs 10 lakh to Rs 12.5 lakh, tax rate payable will be 20 percent, Sithraman proposed.

"For Income between Rs 12.5 lakh to Rs 15 lakh, the tax rate will be reduced 25 percent. For Income above Rs 15 lakh, income tax rate will remain at 30 percent," she said.

Those earning up to Rs 5 lakh will not pay any tax as announced in interim Budget 2019.

The new income tax rates will, however, not allow exemptions under Section 80C. Home loan exemption, insurance exemptions, standard deduction will also not stay under the regime.

NPS subscribers, on the other hand, will continue to avail deduction under Section 80CCD(2) as this deduction is not amongst those to be excluded to avail new tax slabs.

This means individuals will now have two regimes like in case of corporates, said experts. "That will make myriad rates and a complex structure," they added.

The current tax slab

According to the current rules, a slab system functions across the country, where different tax rates have been prescribed for different slabs.

As per the existing rules, if the total income of an individual is not more than Rs 2.5 lakh, the tax rate is nil. If the income falls in Rs 2.5 lakh-Rs 5 lakh bracket, 5 percent income tax is payable. However, those earning up to Rs 5 lakh can claim a rebate of Rs 12,500 under Section 87A of the Income Tax (I-T) Act.

For individuals earning Rs 5 lakh to Rs 10 lakh, tax is deducted at the rate of 20 percent. If the total income of an individual is more than Rs 10 lakh, 20 percent tax is payable.

First Published: Feb 1, 2020 1:16 PM IST