If you have Rs 2 lakh to invest what are your best options? Well, while it might be difficult to mention any one investment, CNBC-TV18.com spoke to a few experts to get a sense of what should be the best approach in the current environment.

Live TV

Loading...

Here are the options:

Equity investments

Pawan Parakh, Director, Renaissance Investment Managers thinks that equity is the most rewarding asset class to bet on.

“Interest rates aren’t good enough to cover for inflation. With more formalization of the economy, a substantial amount of money which otherwise was flowing into real estate is no longer the case. Real estate now mainly attracts demand from users and not investors. The growth outlook for the Indian economy is quite promising, which makes the investment case in equity even stronger,” Parakh advises.

However, he thinks that investors should be cognizant of the fact that equity has higher risks versus asset classes like debt.

So, how should you allocate?

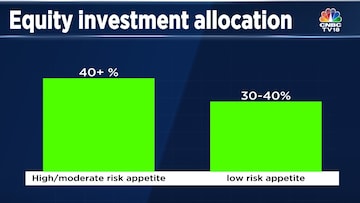

“If you with moderate/high-risk appetite, you should have a higher allocation to equities. On the other hand, if you an investor with low-risk appetite, you can have 30-40 percent exposure to equities and the balance towards debt,” he adds.

Within equities, Parakh believes that the allocation should be higher towards large caps and more importantly it should be quality stocks/mutual funds.

“Investors should not blindly chase returns but try to maximize risk-adjusted returns. In the absence of risk frameworks, equity portfolios can see huge drawdowns, which can cause both financial and emotional loss,” he cautions.

Mutual funds

Investors can also consider investing in mutual funds as they can also help in diversifying unsystematic risks. While individual stocks have both unsystematic and systematic risks, mutual funds are only subject to systematic risk or market risk.

Alternative Investment options

Investors who already have an existing portfolio of low-risk, low-return products along with some exposure to equity via stock or mutual funds, should go for Alternative Investment options, says Nikhil Aggarwal, Founder & CEO at Grip.

“As the name suggests these assets add value to your existing investment portfolio by offering you a fair bit of diversification and these are not directly linked to the ups and downs of the stock market. To build such a portfolio you would need to include things like Asset Leasing, Inventory Finance, Startup Equity and Commercial Real Estate. This will help you diversify and earn predictable returns for your medium and long-term goals," Aggarwal advises.

"Additionally, you could even stagger Rs 2 lakh amount across multiple alternative investments that align with your expectations the most. These options offer pre-tax yields ranging from 10 percent - 21 percent internal rate of return," Aggarwal says.

First Published: Aug 3, 2022 5:23 PM IST

Note To Readers

Disclaimer: The views and investment tips expressed by investment experts on CNBCTV18.com are their own and not that of the website or its management. CNBCTV18.com advises users to check with certified experts before taking any investment decisions.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM