The All-India Aspiration Index for 2023 has taken a downturn, falling to 85.3 from last year's 87.3, according to the latest report from BankBazaar, an online marketplace for financial products. This is the first time the aspiration index has declined since 2020, signalling that the high costs of living and the burden of borrowing are impacting the dreams and ambitions of Indians.

Live TV

Loading...

The BankBazaar Aspiration Index survey, which focuses on salaried individuals aged 22-45 years across India, sampled 1,732 respondents from six major metros and 18-plus tier 2 cities. The study explored 17 goals under five primary aspirations: health, wealth, fame, relationships, and personal growth. A higher index indicates higher aspirations, while a lower score implies hesitation.

The revelations

Non-metros are yet to take back their pre-pandemic lead when it comes to aspiration index, but this year's gap of 1.6 has narrowed from last year’s 2.6. While aspiration index for metros stood at 85.7, the same for non-metros stood at 84.1, the report said.

When talking about regions, all four of them had lower indices from 2022. Resilient East lost its top spot and moved to the bottom with a steep fall of 4.1 points over last year. The South, North, and West clustered closely together in the 85s.

(Source: BankBazaar)

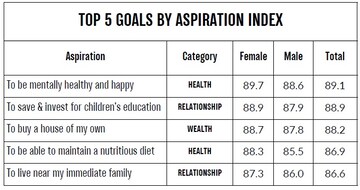

(Source: BankBazaar)Aspirations and gender dynamics

Despite a declining workforce participation rate, Indian women continued to drive aspirations, surpassing men with an Aspiration Index of 86.1, although both genders saw a decrease compared to the previous year. Women aged 28-34 years exhibited the highest aspirations, closely followed by women aged 35-45 years. In contrast, early jobber males (22-27 years) displayed the lowest aspirations, with muted desires for world travel.

Aspirations and mental health

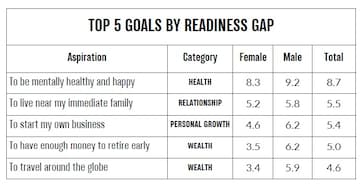

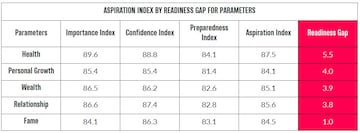

While health predictably had the highest Aspiration-Readiness gap at 5.5, it was followed by personal growth at 4.1. Mental health had the highest gap at 8.7 followed by living near family (5.5) and entrepreneurship (5.4), as per the report.

Mental health has taken centre stage as the top aspiration for Indians, closely followed by the desire to live near family and venture into entrepreneurship. Interestingly, the aspiration index not only measures the importance people place on their dreams but also their confidence in achieving them. This leads to the identification of a readiness gap, with mental health showing the highest gap, indicating a strong desire but limited preparedness.

Wants and needs alignment

Mental health topped the study for the second time in a row. Homeownership and children’s education returned to the top three, the report said.

(Source: BankBazaar)

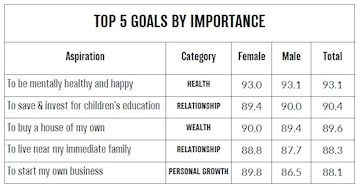

(Source: BankBazaar)Importance vs index

What India wants and what it prioritises can be two different things. Four of the top five goals by importance make it to the top of the index. The only one to miss out is start-up aspirations, lowered by responses from men who come across as fatigued in this year’s study. It’s women doing the driving again.

(Source: BankBazaar)

(Source: BankBazaar)This year’s readiness gap for mental health is one of the highest ever seen for any goal in the Aspiration Index. Start-up, travel, and retirement aspirations are also a challenge at the moment. Once again, men were seen to be struggling more on all parameters. On retirement, the gap is nearly double, BankBazaar said.

(Source: BankBazaar)

(Source: BankBazaar)Shifting priorities

India unequivocally said its top aspiration is health with an index of 87.5. To be mentally happy and healthy had an Aspiration Index of 89.1, the top goal by a distance. Investing in children is the second most important aspiration (88.9), while living near family and long-lasting friendships were in the 86s.

Homeownership continued to rank up there among the top three goals. However, India is lagging behind other wealth aspirations. Low aspirations for travel (83.1) and, worryingly, retirement (84.1) drag the wealth index to 85.1. Buying premium products is a middling 85.0.

The survey revealed that early retirement, once among the top five goals for 28 percent of respondents, has slipped to the ninth position this year. Additionally, it has fallen from the second most important reason to invest to the sixth place. This shift in retirement priorities is accompanied by a 4 percent dip in the number of people with a retirement corpus.

Like many other indices this year, fame aspirations are being pulled largely by women power. Oddly, early jobbers, on the whole, fared badly on all three goals—men even more so. Wealth Warrior women had the highest aspirations to be social media influencers (91.4). Women money mooners (90.3) had the highest aspirations to be seen as the go-to person at work or in society.

(Source: BankBazaar)

(Source: BankBazaar)Roadblocks to aspirations

High living costs emerged as the most significant roadblock to aspirations for 48 percent of respondents, closely followed by limited savings at 44 percent and a tax regime not adjusted for inflation at 30 percent. High borrowing costs have also significantly impacted aspirations, affecting a staggering 82 percent of respondents, with 74 percent experiencing more expensive loans and 42 percent witnessing an increase in equated monthly instalments (EMIs).

Changing loan landscape

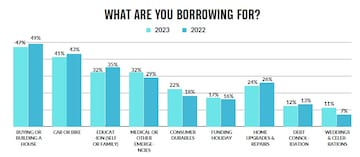

The report also highlighted a noticeable decline in people taking loans for various purposes, including housing, vehicles, education, and home improvement. Interestingly, more people (19 percent) had credit liability compared to the previous year (14 percent), reflecting a shift in financial priorities.

At the same time, the number of people servicing loans taken for medical and other emergencies went up by 3 percentage points.

(Source: BankBazaar)

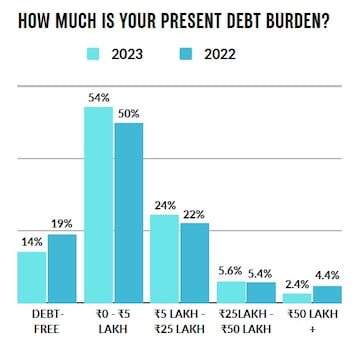

(Source: BankBazaar)Fewer people are now debt-free

The percentage of people without any open credit liability is down to 14 percent from last year’s 19 percent.

(Source: BankBazaar)

Interest rates pinch

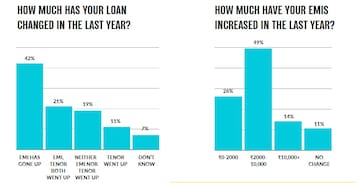

Rising inflation and interest rates have had a big impact on people’s pockets. Around 74 percent saw loans become more expensive. Around 42 percent saw EMIs go up and 21 percent have seen both EMI and tenure increase.

(Source: BankBazaar)

Of these, 76 percent saw interest rate increase by more than 1 percent. The hike has been more than 3 percent for 21 percent. That’s an increase of Rs 0-2,000 for 26 percent of people and Rs 2,000-10,000 increase for 50 percent.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM