Arbitrage mutual funds have drawn the spotlight in recent months, experiencing a notable surge in investor inflows. In July alone, these funds saw an influx of Rs 10,074 crore, marking a significant increase in interest compared to other hybrid mutual fund schemes. This surge raises the question: What exactly are arbitrage funds, and why are they becoming the favoured choice for investors?

Live TV

Loading...

An overview

Arbitrage mutual funds operate on a unique investment strategy that capitalises on price discrepancies between various market segments. These funds typically consist of two main components: the equity book and the debt book. To shed light on this strategy, we spoke with Karthik Kumar, Fund Manager at Axis Mutual Fund, who shared insights into the inner workings of these funds.

Kumar explained that the equity book entails a carefully hedged portfolio of stocks, supported by short future positions. The primary objective is to maximize returns by identifying mispriced stocks and their corresponding counter-futures. This approach has proven fruitful, particularly due to the prevailing favourable equity spreads, which have maintained a robust range of 7.8 percent to 9 percent over the last three expiry series.

"The recent market uptrend, fueled by substantial participation from Foreign Institutional Investors (FIIs) and High Net Worth Individuals (HNIs), has contributed significantly to these strong spreads," he told CNBC-TV18.com.

On the other hand, the debt book comprises highly liquid debt instruments and mutual funds, strategically chosen as marginable securities. The fund manager in this segment actively oversees a portfolio of short-tenor securities, aiming to strike a delicate balance between risk and return. Allocations between the equity and debt books vary dynamically, factoring in the ever-shifting opportunity costs between these two asset classes.

The trigger behind the surge

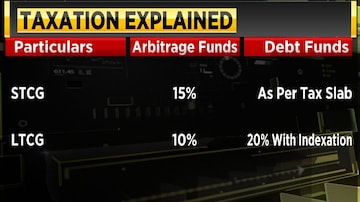

One of the key catalysts for the rising interest in arbitrage funds stems from the diminishing allure of debt funds. The loss of the indexation benefit on Long-Term Capital Gains (LTCG) has rendered debt funds less attractive to investors.

According to the new debt fund taxation rules, the indexation benefit on LTCG is no longer available for investments undertaken on or after 1 April 2023. Instead, the gains are being added to the investor's taxable income and taxed as per their tax slab.

Consequently, investors are exploring alternative investment avenues, and many have found their answer in arbitrage funds. This is because arbitrage funds invest primarily in equities. This is why they are taxed as equity funds, and the tax rate is much lower for them than the ordinary income tax rate levied on other types of funds.

Due to the absence of pure equity exposure, these funds benefit from equity taxation. Consequently, investors falling within the 20 to 30 percent tax bracket, seeking tax efficiency, would find this investment segment highly intriguing.

Moreover, the heightened market volatility observed in recent months has further enhanced the earning potential of these funds. Data shows arbitrage funds tend to outperform other funds and provide better returns when the market is unable to find a particular direction.

During volatile markets, fund managers take advantage of differentials in current prices and future prices of a security. For example, a fund manager can buy shares in the cash market and sell the same stock and the same quantity in the futures or derivatives market, earning the differential without taking any risk. Also, speculative activity is on the rise during market volatility, so demand for security in the futures market could be higher than in the cash market, leading to a higher differential.

A look at returns of arbitrage funds

| Scheme Name | 1-year return | 3-year return | 5-year return |

| Tata Arbitrage Fund - Direct Plan - Growth Arbitrage Fund | 7.51% | 5.46% | - |

| Invesco India Arbitrage Fund - Direct Plan - Growth Arbitrage Fund | 7.89% | 5.61% | 5.84% |

| SBI Arbitrage Opportunities Fund - Direct Plan - Growth Arbitrage Fund | 7.74% | 5.39% | 5.56% |

| Nippon India Arbitrage Fund - Direct Plan - Growth Arbitrage Fund | 7.49% | 5.42% | 5.86% |

| Edelweiss Arbitrage Fund - Direct Plan - Growth Arbitrage Fund | 7.55% | 5.50% | 5.92% |

| Mirae Asset Arbitrage Fund - Direct Plan - Growth Arbitrage Fund | 7.41% | 5.28% | - |

| ICICI Prudential Equity - Arbitrage Fund - Direct Plan - Growth Arbitrage Fund | 7.41% | 5.32% | 5.67% |

| Bandhan Arbitrage Fund - Direct Plan - Growth Arbitrage Fund | 7.49% | 5.28% | 5.68% |

(Source: Moneycontrol)

Is it worth investing?

According to Kumar, arbitrage funds are particularly suitable for investors seeking tax-efficient parking solutions. The recommended investment horizon for these funds is typically three months or longer.

"Recent trends indicate that arbitrage funds offer a relatively favourable risk-return profile compared to other available parking solutions. The combination of the unique investment strategy and the prevailing market conditions has bolstered their appeal," he said.

Factors to consider before investing

For potential investors, several factors play a crucial role in determining whether arbitrage funds align with their investment goals. These factors include market volatility, participation in the Futures and Options (F&O) market, the trajectory of interest rates, and the prevailing liquidity conditions in both the equity and debt markets. The intricate interplay of these elements defines the arbitrage opportunity set and subsequently influences the overall return profile of the category.

As always, careful consideration of market dynamics and investment goals remains paramount before making any financial decisions.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!