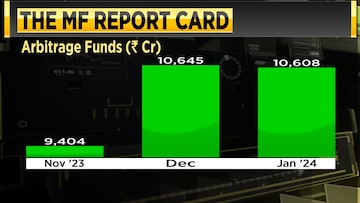

Arbitrage Funds, known for their steady performance and low-risk nature, have been witnessing consistent inflows in recent months. January saw an influx of ₹10,608 crore, slightly below December's figure of ₹10,645 crore but still indicative of a robust trend since November last year.

So, what exactly do arbitrage funds entail?

Arbitrage funds aim to exploit price differentials between derivatives and cash (spot) markets.

This is achieved through simultaneous buy and sell transactions in both cash and futures markets. These funds are particularly tailored for new investors with a low-risk appetite.

Santosh Joseph, Founder & Partner at Germinate Investor Services LLP, highlighted the strong performance of

arbitrage funds in terms of returns and investor interest.

One key factor contributing to their appeal is the tax benefits they provide.

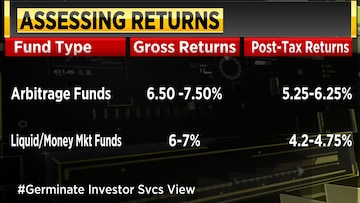

Speaking to CNBC-TV18, Joseph stated, "Positive taxes, positive yields, both are a great opportunity for investors to consider. This opens up a beautiful alternative for those seeking liquid, money market, and ultra-short-term options but with a slightly longer timeframe."

However, the question arises: who should consider investing in these funds, and for what duration?

Joseph underscores the importance of a short to medium-term investment horizon when contemplating arbitrage funds.

These funds are not suitable for long-term investors anticipating equity-like returns.

Yet, for those with a time horizon of three to six months or more, arbitrage funds can offer superior post-tax yields compared to liquid or money market funds.

"If you have an investment horizon of three months or more, and six months, that's great. If you can extend it to 12 months, your post-tax yields become even more appealing," Joseph noted.

For full interview, watch accompanying video