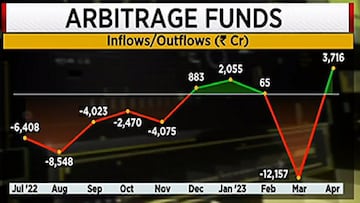

Arbitrage funds are back in favour. They have lately experienced increased inflows driven by market volatility and favourable post-tax returns relative to liquid funds. According to the April AMFI Data, a total of 26 asset management companies (AMCs) are offering arbitrage schemes, with a collective managing assets worth around Rs 81,000 crore.

Decoding arbitrage funds

These funds typically are hybrid mutual funds that generate returns by using the strategy of simultaneously buying and selling the same underlying security or its derivatives in different market segments to make risk free profits.

So, if the price of the same object is different in different markets, investors can make risk free profits by buying the object in the market where price is lower and simultaneously sell it in the market where price is higher.

The trigger

According to Harshvardhan Roongta, CFP at Roongta Securities, the recent tax changes in debt funds have resulted in a significant inflow into arbitrage funds.

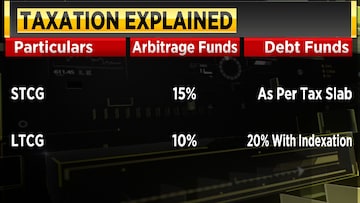

Under the new tax regime,

debt funds are subjected to short-term capital gains tax, regardless of the holding period.

"This shift in taxation has made arbitrage funds more attractive option for investors compared to debt funds such as liquid funds, ultra-short-term funds, low-duration funds, and money market funds," Roongta told CNBC-TV18.

This is because arbitrage funds invest primarily in equities. This is why they are taxed as equity funds, and the tax rate is much lower for them than the ordinary income tax rate levied on other types of funds.

Due to the absence of pure equity exposure, these funds benefit from equity taxation. Consequently, investors falling within the 20 to 30 percent tax bracket, seeking tax efficiency, would find this investment segment highly intriguing.

Additionally, Roongta said that these funds operate by simultaneously buying and selling securities to capture the price difference between two markets, thereby securing profits.