As the annual appraisal season rolls around, employees must be getting eager for a salary raise. But more often than not, when employees demand a salary hike, they overlook the fact that an increase in basic salary would directly translate into higher tax payments.

Live TV

Loading...

Only a few consider restructuring their salary. However, this should be done to reduce the income tax burden.

For any job holder, the calculation of income tax is based on their basic salary, which forms the core of their earnings.

Hence, it's often advised that the basic salary should not exceed 40% of the Cost to Company (CTC). Including allowances in the salary structure can further assist in reducing taxable income.

Let's explore key considerations for restructuring salary to optimise tax savings:

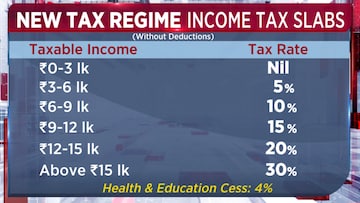

Choose the right income tax regime

The new tax regime offers more tax slabs with higher rates.

Opting for the new tax regime means foregoing tax benefits available under the old regime.

So, individuals without significant savings might find the new regime beneficial.

Balancing basic salary and allowances

Basic salary typically ranges between 40% and 50% of CTC.

A high basic salary increases tax liability, while focusing on benefits may reduce take-home pay.

Balancing these two is crucial for a tax-efficient salary structure.

Senior employees in higher tax brackets prefer tax savings over a higher take-home salary. Hence, they opt for a lower basic pay.

Conversely, junior employees may need higher monthly payouts, achieved by lowering the basic salary and opting for fixed allowances.

Leveraging allowances

Allowances like House Rent Allowance (HRA) and Leave Travel Allowance (LTA) provide tax benefits.

HRA is claimable if the employee lives in a rented house, reducing taxable income. LTA, meanwhile, is exempted only for domestic trips with family members, subject to certain conditions.

Utilising perquisites

Perquisites or perks, like company-provided cars or rent-free accommodation, can be included in the salary structure to avail of tax exemptions.

For instance, TDS on Employee Stock Options (ESOPs) from startups is waived, but taxes are payable on exit.

Maximising retirement benefits

Contributions to retirement schemes like EPF offer tax benefits under Section 80C.

Balancing retirement savings with take-home pay is crucial.

Employees, especially in higher tax brackets, may choose to contribute more to EPF for better returns.

Understanding tax calculation

Taxable income is calculated by deducting exemptions from total earnings.

Proper structuring of salary components can maximise exemptions and minimise tax liability.

(Edited by : Amrita)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM