The UPI (unified payments interface) has taken a new avatar – this time as a medium for applying to IPOs (initial public offerings).

Live TV

Loading...

Market regulator SEBI has made it mandatory for retail investors to apply only through the UPI route.

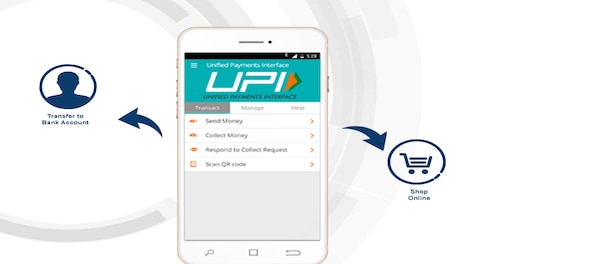

The introduction of the UPI facility is eventually expected to quicken the entire IPO process. Affle India’s IPO, which opened on Monday, will be the first instance of application through the medium. The UPI system allows the instant transfer of funds between two banks.

Till recently, you could invest in an IPO using the ASBA (application supported by blocked amount) facility offered by SCSBs (Self-certified syndicate banks). Here, you needed to mention your bank account’s name and account number. Upon receiving your application, your bank would block the amount equivalent to the value of shares you applied for. When the company finally allots you shares, then the amount goes out of your bank account and you get your allotted equity shares in your demat account.

UPI-based IPO application is made mandatory for retail investors who have accounts with banks whose names appear on SEBI’s website.

If your bank is not live on the UPI, you may submit your application form with SCSB or using the facility of linked online trading, demat and bank account.

How the new system works

Under the new system, your IPO application form will have two unfilled parts pertaining to ASBA and UPI. If your bank is on the UPI list, you can the ASBA portion on your form and move to the UPI part. Mention the UPI ID as payment option. You will then receive a ‘block mandate’ request on your chosen UPI app. Accept this request by entering your UPI PIN (personal identification number). Upon acceptance of the request, the required amount is blocked. Depending on the number of shares allotted by the company whose IPO you applied for, the funds are debited from the bank account.

To prevent UPI frauds, make sure you check the ‘verified merchant’ tag while accepting the ‘block request.’ You should also check the bid-cum-application number, amount and other details. In case you face a technical error, incorrect PIN entry, accidental declining of the request, you can re-initiate the request by approaching the intermediary through which you are applying for the IPO. As uploading of bids in an IPO happens only on a working day, you will get the ‘collect funds’ request only on a working day. However, you can accept these requests on a holiday too, as the UPI framework works on holiday too. For revocation and modification of your application till the IPO’s closure, you have to initiate the process through the intermediary in the prescribed format.

Even if you do not have a UPI ID, you can bid in an IPO. Your bank account number should be linked with your mobile number and you should have a debit card. With the help of these, you can activate your UPI ID on the bank’s application within minutes. Your bank’s customer care can help you create one.

The UPI option in the IPO process ensures minimal rejections on account of signature mismatch and other such glitches. In the earlier ASBA system, your signature on the IPO form needed to match with that on the bank’s records. Even a slight mismatch could result in your IPO form getting rejected. The travel time also drops drastically as the forms would need to be sent from the syndicate banks (the banks that accept an IPO application) to your own bank branch where you have your savings account. Under the UPI-based application method, when the syndicate banks send you a request to block an amount on your UPI app, your acceptance of the request on the phone (through your UPI app) is considered as proof that you are indeed the same investor who has applied for the IPO through the physical form. This new process of application should also reduce the time between the closure of an IPO and the listing of shares.

Source: Moneycontrol.com

First Published: Jul 30, 2019 2:20 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Odisha: Fight of heavyweights in Sambalpur where farmers, weavers hold the key

May 17, 2024 10:22 AM

Lok Sabha Election 2024: What rural Delhi wants

May 16, 2024 10:10 PM

Over 50 onion farmers detained in Nashik ahead of PM Modi's visit

May 16, 2024 11:14 AM

Why Google CEO is cautiously optimistic about the election year

May 16, 2024 9:51 AM