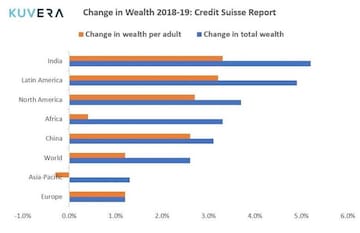

Credit Suisse Global Wealth Report released on Monday showed that 759,000 Indians have wealth over $ 1 million, up from 725,000 millionaires in 2018. India now hosts 2 percent of the global millionaires. Total household wealth in India increased to $ 12.6 trillion in 2019, a jump of 5.2 percent from 2018. Wealth per adult increased by 3.3 percent during the last one year and now stands at $14,569.

Live TV

Loading...

Source: Credit Suisse Global wealth report 2019

Source: Credit Suisse Global wealth report 2019As per the report, Indians hold an average of about $13,000 in physical assets and roughly $3,000 in financial assets. Debt per adult comes to $1,345. The report also projects total wealth in India to grow by 43 percent over the next five years.

In a welcome news for the economy, India moved from 77th to 63rd position in World Bank’s Ease of Doing Business rankings. India’s ranking has consistently improved from 142nd in 2014 to 63rd in 2019. The government had earlier set a target of becoming one of the top 50 countries in the ease of doing business rankings by 2020.

A nation's ranking on the Ease of Doing Business Index is based on the average of the following ten criteria:

1. Starting a business

2. Dealing with construction permits

3. Getting electricity

4. Registering property

5. Getting credit

6. Protecting investors

7. Paying taxes

8. Trading across borders

9. Enforcing contracts

10. Resolving insolvency

With the implementation of the Insolvency and Bankruptcy Code (IBC), the country jumped 56 places from 108th to 52nd in resolving insolvency. The time taken for resolving insolvency has reduced from 4.3 years to 1.6 years.

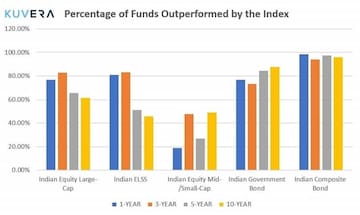

SPIVA (S&P Index vs Active) published the mid-year report for 2019 this week. SPIVA studies the performance of active managers against benchmark indices all over the world. Their India report includes a ten-year comparison of index versus active funds in the Indian mutual fund landscape.

The report shows that over the one year period ending June 28, 2019, 76.67 percent of Indian equity largecap funds and 80.95 percent of Indian Equity Linked Saving Scheme (ELSS) Funds underperformed compared to their respective benchmarks. On the other hand, 81.08 percent of Indian mid/smallcap equity funds outperformed the benchmark over the one year period ending June 2019.

Source: SPIVA India Scorecard Mid-Year 2019

Source: SPIVA India Scorecard Mid-Year 2019

Movers and shakers

1. ICICI Prudential Mutual Fund has appointed Bernard Teo as director on the board of ICICI Prudential Asset Management Company Limited, with effect from October 23, 2019.

2. Franklin Templeton Mutual Fund appointed Sanjaya Johri as an Independent director on the board of Franklin Templeton Trustee Services Private Limited, with effect from October 17, 2019.

Quote of the week

John D. Rockefeller Jr.: The secret of success is to do the common thing uncommonly well.

Gaurav Rastogi is the CEO of Kuvera.in: India’s first completely free direct mutual fund investing platform.

Read his columns here.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Yadav family members in focus in third phase of Lok Sabha polls in Uttar Pradesh

May 6, 2024 12:59 PM

Haryana Lok Sabha elections 2024: Seats, schedule, Congress-led INDIA bloc candidates and more

May 6, 2024 12:09 PM

Andhra Pradesh: Kuppam loyalty test for TDP chief Chandrababu Naidu

May 6, 2024 9:35 AM