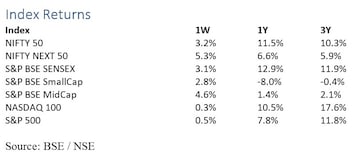

The markets posted strong gains this week on the back of foreign investor inflows, progress in US-China trade talks and deal being reached on Brexit. Sensex rose 3.1 percent and Nifty gained 3.2 percent this week amid sustained buying across sectors. This again highlighted how difficult it is to predict short term movements of the markers. Speculators who were wondering why the market fell recently, are now wondering why it is up this week. Given this backdrop, we would reiterate to stick to your asset allocation and to continue investing as per your plan.

Live TV

Loading...

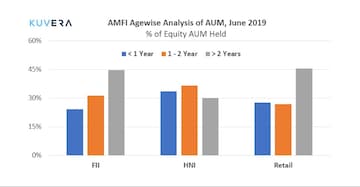

At least a few data points coming out of Association of Mutual Funds in India (AMFI) supports that retail investors are sticking to their investment plan. The systematic investment plan (SIP) contribution has increased to Rs 49,361 crore in the first six months of this financial year, up 11 percent from the previous year. Additionally, retail investors are holding investments longer than high net worth investors (HNIs) and foreign institutional investors (FIIs). As of June 2019, 46 percent of retail assets were owned for more than two years compared to 30 percent of HNI assets.

Reliance Capital has delayed the payment of interest/principal obligations for two non-convertible debentures (NCDs), as per its filing with the exchange. The delay in payment supersedes the ratings downgrade by CARE in September when the company's entire outstanding debt was downgraded to default CARE D rating.

The Securities and Exchange Board of India (Sebi) has accepted AMFI’s graded exit load recommendations for redemptions in liquid funds. AMCs would hereon charge 0.0070 percent, 0.0065 percent, 0.0060 percent, 0.0055 percent, 0.0050 percent and 0.0045 percent exit load respectively for redemptions from liquid funds within one to six days of investment. This move is in line with the objective of lowering the volatility in liquid funds.

Movers and shakers

1. Canara Robeco Mutual Fund announced Krishna Sanghavi resignation from the services of Canara Robeco Asset Management Company Ltd with effect from 12 October 2019.

2. Principal Mutual Fund announced the resignation of Dhimant Shah – senior fund manager resignation from the services of Principal Asset Management Private Limited. Ravi Gopalakrishnan will take over the fund management responsibilities.

3. Principal Mutual Fund announced Ashish Aggarwal's appointment as associate fund manager of Principal Hybrid Equity Fund.

4. Franklin Templeton Mutual Fund announced Sanjaya Johri's appointment as an independent director on the board of Franklin Templeton Trustee Services Private Limited, with effect from 17 October 2019.

Quote of the week

Dita Von Teese: Some days are just bad days, that's all. You have to experience sadness to know happiness, and I remind myself that not every day is going to be a good day, that's just the way it is.

Gaurav Rastogi is the CEO of Kuvera.in — India’s first completely free direct mutual fund investing platform.

First Published: Oct 20, 2019 12:38 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM