A mutual fund pools money from multiple investors having similar financial goals and invests the corpus in securities with an aim of achieving the investment objective of the fund. With respect to the approach of the fund manager, there are two types of funds – actively managed funds and passively managed funds.

Live TV

Loading...

In the case of active funds, the fund manager actively manages the composition of the fund and makes purchase/redemption decisions to ensure that the financial goals of the funds are met. On the other hand, passive funds seek to replicate the performance of a specific index.

Performance comparison

Some studies have shown that over the long term, passive funds tend to outperform a majority of actively managed funds, largely due to their lower fees and reduced portfolio turnover.

However, Sonam Srivastava, Founder & CEO at Wright Research believes there are instances where skilled active managers can consistently beat the market.

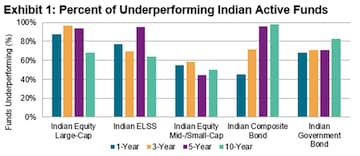

Here's a look at the percent of underperforming active funds:

Indeed, a look at returns for equity diversified schemes of several top fund houses reveals that their performance has mostly been in sync with returns generated by passive funds. Here's a look:

| RETURNS FOR ACTIVE VS PASSIVE FUNDS | |||||||

| Scheme Name | Category Name | AuM (Cr) | 1Y | 2Y | 3Y | 5Y | 10Y |

| DSP Flexi Cap Fund - Direct Plan - GrowthFlexi Cap Fund | Flexi Cap Fund | 7,847.24 | 20% | 10% | 26% | 13% | 16% |

| Franklin India Flexi Cap Fund - Direct - GrowthFlexi Cap Fund | Flexi Cap Fund | 10,370.11 | 18% | 14% | 32% | 13% | 16% |

| HDFC Flexi Cap Fund - Direct Plan - GrowthFlexi Cap Fund | Flexi Cap Fund | 33,221.69 | 25% | 19% | 36% | 14% | 16% |

| UTI Flexi Cap Fund - Direct Plan - GrowthFlexi Cap Fund | Flexi Cap Fund | 24,236.57 | 10% | 6% | 25% | 12% | 15% |

| HDFC Large and Mid Cap Fund - Direct Plan - GrowthLarge & Mid Cap Fund | Large & Mid Cap Fund | 8,589.48 | 22% | 17% | 35% | 14% | 12% |

| ICICI Prudential Large & Mid Cap Fund- Direct Plan - GrowthLarge & Mid Cap Fund | Large & Mid Cap Fund | 7,364.44 | 21% | 19% | 35% | 14% | 16% |

| Kotak Equity Opportunities Fund - Direct Plan - GrowthLarge & Mid Cap Fund | Large & Mid Cap Fund | 12,513.67 | 21% | 15% | 30% | 15% | 17% |

| SBI Large & Midcap Fund - Direct Plan - GrowthLarge & Mid Cap Fund | Large & Mid Cap Fund | 10,512.26 | 22% | 17% | 34% | 14% | 17% |

| UTI Mastershare Unit Scheme - Direct Plan - GrowthLarge Cap Fund | Large Cap Fund | 10,556.95 | 14% | 11% | 25% | 12% | 14% |

| ICICI Prudential Multicap Fund - Direct Plan - GrowthMulti Cap Fund | Multi Cap Fund | 7,172.97 | 22% | 15% | 30% | 13% | 16% |

| UTI Value Opportunities Fund - Direct Plan - GrowthValue Fund | Value Fund | 6,815.09 | 16% | 12% | 28% | 12% | 13% |

| HDFC Index Fund - Nifty 50 | Nifty Index Fund | 8267.68 | 17% | 12% | 27% | 12% | 12% |

| Active Fund Underperformers vs Index Fund (Total 11 schemes) | 3/11 | 3/11 | 3/11 | 0/11 | 0/11 | ||

| Source: Moneycontrol | |||||||

Cost structure

Passive funds tend to have lower expense ratios compared to actively managed funds. This is because they require less research, trading and management, resulting in lower costs. Over time, these cost savings can compound and make a significant difference in an investor's total returns, Srivastava said.

Diversification and risk management

While both active and passive funds offer diversification, their approaches to risk management can differ.

ALSO READ | Key trends from April AMFI data: Equity inflows decline sharply, investors flock to gold ETFs and more

"Actively managed funds may take more concentrated positions in specific stocks or sectors to generate alpha, which can introduce additional risk. Passive funds, on the other hand, typically maintain broad exposure to the entire market or index, leading to lower levels of risk," Srivastava told CNBC-TV18.com.

Market conditions

The relative performance of active and passive funds can be influenced by market conditions. In periods of high market volatility or when stock correlations are low, active managers may have more opportunities to add value through stock selection and tactical asset allocation. Conversely, during periods of low volatility or high correlations, passive funds may outperform due to their low costs and broad exposure.

But, which is better?

Experts say that both these investment approaches are suited to different types of mutual fund investors. Actively managed funds help diversify options and switch to better investment options in case the selected portfolio isn’t working well, which is a huge advantage to investors. Hence, customers who understand the markets and are willing to do their own research can create a basket of actively managed funds for their investments.

According to Vivek Sharma, Director (Strategy) and Head of Investments at Gulaq, the retail advisory arm of Estee Advisors, the two things required by investors of an active funds are patience and conviction.

"We know that most of the active funds underperform the markets. But then there are few funds, which have done a phenomenal job. Most of the good active funds do go through long periods of underperformance. What is required during those periods of underperformance is the patience to ride the underperformance and also conviction that this is a phase which will get over and the active fund would start performing again," Sharma said.

To understand, investors who are looking to invest with the objective of achieving market-beating returns but want an expert fund manager to manage their investments can consider opting for active mutual fund schemes.

While talking about passive mutual funds, experts say they have a low expense ratio since there is no oversight or management needed that brings the costs down. However, these funds are limited to investing in a predetermined set of securities. Hence, investors are stuck with these investments no matter how the markets perform.

But these may be a good option for someone who might be uncomfortable for divergence between the returns delivered by their fund and the underlying benchmark or index.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP replaces Poonam Mahajan with lawyer Ujjwal Nikam for Mumbai North Central Lok Sabha seat

Apr 27, 2024 7:53 PM

Meet Amritpal Singh, the separatist leader contesting Lok Sabha polls from Punjab's Khadoor Sahib

Apr 27, 2024 7:18 PM