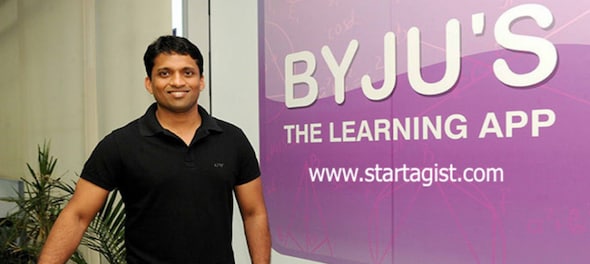

A group of shareholders of troubled edtech firm Byju’s have called for an extraordinary general meeting (EGM) on Friday, February 23, to remove its founder Byju Raveendran as the group’s chief executive officer, and appoint a new board.

CNBC-TV18 was the first to report the development on February 1, and has now accessed the EGM notice which details the reason for the removal of Raveendran, and appointment of a new board, raising concerns about financial mismanagement by the current founders, and lack of transparency in dealing with various matters.

The shareholders who have called this EGM include Prosus, General Atlantic, Peak XV, Sofina, Chan Zuckerberg Initiative, Owl Ventures and Sand Capital Management, representing over 30% of the shareholding in the company, CNBC-TV18 had earlier reported.

The EGM notice has listed seven items on the agenda for shareholders to vote on. The key among them being the removal of Byju Raveendran as the managing director and CEO of the company and both Divya Gokulnath and Riju Raveendran from their respective management roles and as directors.

The notice seeks shareholders’ approval to, “consider immediate changes in the management of the Company to prevent further dilution of value to the shareholders by removing Byju Raveendran as CEO, and removal of both Divya Gokulnath and Riju Raveendran from their respective management roles and as directors and as signatories on any bank accounts, and to consider further changes in management leadership of the Company keeping in mind the exigencies of the business in view of the performance of the founders and current executive team.”

The EGM notice also proposes that an interim CEO be appointed in place of Byju Raveendran, and a search firm be engaged to find a new CEO to take over the company’s affairs.

The notice reads, “…to identify an appropriate interim Chief Executive Officer or entity to manage the affairs of the Company, as well as a search firm to identify and consider potential candidates with experience in handling a group of this size and nature, for appointment as Chief Executive Officer of the Company, within 10 (ten) days from the date of the EGM and to consider further changes in management leadership of the Company keeping in mind the exigencies of the business in view of the performance of the founders and current executive team.”

It also proposes that the board be restructured to include nine members, including one founder, two executives from within the group companies, three shareholders and three independents directors. This new Board of Directors of the Company are proposed to be appointed at a subsequent meeting of the shareholders, no more than thirty days from the EGM.

Among other key agenda items, the shareholders have proposed that a forensic expert be appointed, from amongst the Big 4 Accounting Firms or any of the top 10 national law firms, to investigate various actions “including with respect to acquisitions, alleged breaches, regulatory affairs, tax filings and any payments made by the Company and to record any requested recommendations for improvement.”

These group of shareholders have highlighted a series of concerns relating to financial mismanagement of the group, erosion of shareholders value due to management’s failure to enforce the company’s legal rights, breach of obligations to shareholders, and even concealment of information from shareholders.

It cities concerns about the management’s failure to resolve the issues with Term Loan B (TLB) lenders in a timely and responsible manner resulting in the lenders accelerating the loan and expensive and protracted litigation in two US jurisdictions. It also seeks to get the management’s explanation to the notice served by the Enforcement Directorate in November 2023, strategy and response to the insolvency petition filed by the Board of Control for Cricket in India (BCCI), CEO negotiating and facilitating Aakash’s entry into onerous and prejudicial loan terms with Davidson Kempner, delay in filing financial statements, and so on.

These shareholders have also sought a status update on matters including:

Meanwhile, with days to go for the EGM this Friday, Byju Raveendran in a letter to all shareholders claimed that the $200 million rights issue was fully subscribed, even as he asked all investors to participate in the issue. Raveendran in this letter also committed to restructuring the board, and appointing two non-executive directors with the mutual consent of the founders & shareholders right after the FY23 audit is completed. This audit, he claimed, would be closed by the end of the current quarter.

Byju Raveendran also claimed that he has invested $1.1 billion personally into the company in the last two years to pay salaries and keep operations going. He even called the narratives about the founder having an adversarial relationship with shareholders false, and added that there was nothing to be gained from conflict.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi voters can avail free rides from booths to their homes on polling day

May 10, 2024 6:26 PM

Kolkata North: TMC fights 'TMC' in battle reflecting party's Old vs New debate

May 10, 2024 5:14 PM