Shares of Zomato Ltd rallied 14 percent in Friday's trade to hit a 52-week high after the food delivery platform reported a strong set of June quarter (Q1FY24) numbers—achieving net profitability much ahead of expectations (Q4FY24). The superior performance is attributable to expanding contribution margin and adjusted EBITDA margin of both the food delivery and quick commerce segments.

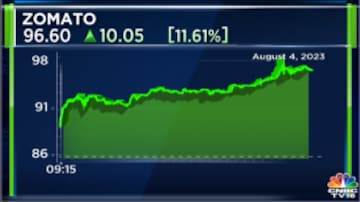

At 11:46 am, the scrip was trading over 11 percent higher at Rs 96.30 apiece on the NSE. The stock surged 14.11 percent to hit a one-year high of Rs 98.40. Zomato shares have gained 28 percent in a month, while on a year-to-date basis, it has climbed nearly 60 percent.

"Zomato has delivered profitability earlier than promised. There is clarity on vastly improving revenue growth. This company in a duopoly business has a long runway for growth. For those investors who bought at low rates partial profit booking is fine. It makes sense to remain invested in this growth stock," said Dr VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Considering the Q1 beat and strong outlook, analysts have raised their target prices on the counter, suggesting over 50 percent upside potential. Jefferies has a target of Rs 130 on the stock, HSBC sees it at Rs 102, JP Morgan at Rs 100, UBS at Rs 90, Morgan Stanley at Rs 85, while Nomura has slashed its target to Rs 60.

| Foreign brokerages | Target price |

| Jefferies | Rs 130 |

| HSBC | Rs 102 |

| JP Morgan | Rs 100 |

| UBS | Rs 90 |

| Morgan Stanley | Rs 85 |

| Nomura | Rs 60 |

Domestic brokerages including Nuvama, Emkay and Motilal Oswal find the stock worth Rs 110.

Zomato turns profitable for 1st time

Zomato posted a profit for the first time. The company said its food delivery platform reported a profit after tax (PAT) at Rs 2 crore for the June quarter against a net loss of Rs 186 crore in the year-ago quarter.

Zomato even delivered on GOV (gross order value) and revenue growth this quarter. Food delivery GOV, after being flat over the last two quarters, jumped sharply, by 11.4 percent quarter-on-quarter (QoQ), led by demand recovery, growing adoption of Gold program that drove higher frequency of ordering, seasonality, and strong execution.

Contribution margin in food delivery improved to 6.4 percent from 5.8 percent QoQ. Blinkit GOV growth was impacted by temporary disruption in April on account of change in the delivery partner payout structure.

Management guides for over 60 percent year-on-year growth in Blinkit GOV (over 20 percent QoQ in Q2) and adjusted EBITDA breakeven in the next four quarters. Overall adjusted EBITDA also turned profitable for the first time, aided by strong revenue growth and cost levers, coupled with operating leverage.

Watch: CNBC-TV18’s Mangalam Maloo and Karan Taurani, Senior VP and Research Analyst-Media, Consumer Discretionary and Internet at Elara Capital discuss Zomato’s Q1FY24 profitability.

Zomato expects adjusted revenue to grow at over 40 percent for at least the next couple of years and remain profitable going forward.

According to Nuvama, the management shied away from giving any growth guidance over the last few quarters due to growth uncertainty. "Strong GOV/revenue growth in Q1FY24 along with guidance of more than 40 percent YoY growth in adjusted revenue for the next two years underscores management’s confidence and provides much-needed visibility."

"With first profitability on books, the focus will turn to FCF generation," Nuvama said, adding, "We continue to have faith in the long-term prospects of the company, and Zomato remains one of our top picks."

First Published: Aug 4, 2023 12:26 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: 28% of candidates contesting in fourth phase are 'crorepatis'

May 9, 2024 4:29 PM

Free poha-jalebi to movie ticket discounts: How cities struggling with 'urban apathy' are luring voters to polling booths

May 9, 2024 3:17 PM