Shares of Zomato made a U-turn in choppy trade on Tuesday as the stock rose as much as 5 percent after initially falling 4.9 percent on the BSE during the morning session.

Investors began trading on a cautious note after the government of India asked online food business operators to submit a proposal within 15 days for improving their consumer grievance redressal mechanism amid rising complaints.

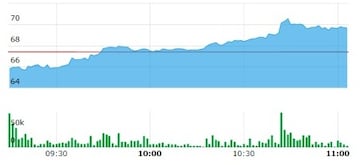

Zomato intraday stock chart (source: BSE)

Zomato intraday stock chart (source: BSE)The Street had initially expressed worries after the department of consumer affairs directed e-commerce food business operators (FBOs) "to transparently show consumers the breakup of all charges included in the order amount such as delivery charges, packaging charges, taxes, surge pricing etc."

The department pointed out that during the last 12 months, around 2,828 grievances had been registered for Zomato.

These issues included "veracity of the amount of delivery and packing charges and the reasonability of such charges, disparity between the price and quantity of food items shown on the platform and actually offered by the restaurant. It also included inconsistency in the delivery time shown to consumers at the time of placing an order and the time at which the order is actually delivered, and absence of any mechanism to separate genuine reviews from fake ones," the official statement said.

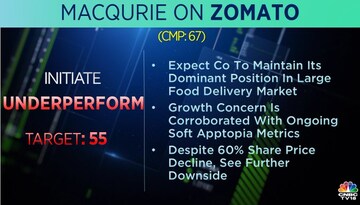

Macquarie had an ‘underperform’ rating on the stock and cut its target price from Rs 67 to Rs 55, an 18 percent downside from its current market price and 83 percent lower from its issue price.

While the brokerage house expects the company to maintain its dominant position in a potentially large food delivery market in India, it expects further downside for Zomato’s share price.

(With inputs from PTI)

Catch all the live market action here

First Published: Jun 14, 2022 1:06 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: 28% of candidates contesting in fourth phase are 'crorepatis'

May 9, 2024 4:29 PM

Free poha-jalebi to movie ticket discounts: How cities struggling with 'urban apathy' are luring voters to polling booths

May 9, 2024 3:17 PM