Online food delivery in India is pretty much a duopoly between Gurugram-based food delivery platform Zomato and Bengaluru-based Swiggy. Between the two, the Deepinder Goyal-led firm has a slight edge over its rival Swiggy. According to analysts, Zomato seems to have retained its market share lead against Swiggy.

Zomato has consistently snatched market share from rival Swiggy in the food delivery vertical in the last five years, according to a research note brokerage firm JM Financial.

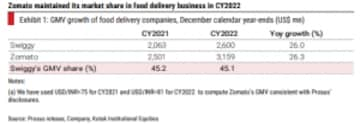

Prosus, which holds a 33 percent stake in Swiggy, said that Swiggy's core food delivery business gross merchandise value (GMV) came in at $2.6 billion, up 26 percent year-on-year and Instamart business GMV increased by 459 percent on-year.

Food delivery order growth of 30 percent on-year was ahead of GMV growth of 26 percent, indicating a decline in either average order value (AOV) or take rates, a trend that was not witnessed by Zomato, according to Kotak Institutional Equities research report.

In comparison, Zomato posted a calender year (CY) 2022 food delivery GMV of $3.2 billion, up 26 percent on-year. This, as per Kotak, suggests a GMV share of 55:45 in favor of Zomato, reflecting strong execution and customer stickiness, despite discounts coming off on the platform.

Zomato seems to have maintained its market share lead in CY 2022, which is an added positive, believe analysts.

Losses widen for Swiggy

The report further said that Swiggy posted trading losses of $545 million for CY 2022, up 80 percent on-year, driven by peak investments in Instamart, its quick commerce business.

"We believe both Zomato and Swiggy are currently annualizing GMV of $1 billion+. Swiggy posted on-year growth of 459 percent in quick commerce GMV, and we believe future growth in it would be more calibrated, given a higher profitability focus," the note stated.

Meanwhile, Zomato's losses appear lower over the same period; however, analysts noted that the Blinkit acquisition was completed only in August last year, and hence the comparison is not like-for-like.

With a target price of Rs 95 per share, Kotak has retained a 'Buy' call on the counter. Shares of Zomato were trading flat during Wednesday's late noon deals. At 3:10 pm, the scrip was trading 0.067 percent higher at Rs 74.90 apiece on the NSE.

The stock has gained 12 percent in the last one month, while it was down nearly half-a-percent in the last five trading sessions. On a year-to-date basis, the stock rallied 24 percent.

Technically, the 14-day relative strength index (RSI) of Zomato stands at 65.1, indicating the stock is neither trading in the overbought nor in the oversold zone. The stock has a one-year beta of 1.5, indicating very high volatility during the period. Zomato shares are trading higher than the 20 day, 50 day, 100 day, 150 day and 200 day moving averages.

(Edited by : C H Unnikrishnan)

First Published: Jun 28, 2023 3:42 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!