Shares of food delivery aggregator Zomato Ltd changed hands on the bourses via a block deal on Monday, August 28. As many as 3.2 crore shares of the company or 0.4 percent of the total equity worth Rs 288 crore changed hands in three large trades. The transaction happened at Rs 90.1 per share. The buyer and seller in the deal are not officially known.

Japanese tech giant SoftBank was likely to offload Zomato shares as the lock-in period for investors post the Blinkit deal ended on Friday, August 25. As a result, the shares received during the Blinkit deal will unlock for trading today.

Zomato issued fresh equity shares to all the selling shareholders of Blinkit as consideration for the merger and acquisition (M&A) last year, at an implied per-share price of Rs 70.76. Pursuant to the transaction, the online food delivery giant had negotiated a 12-month lock-in for these shares, compared to the statutory lock-in requirement of six months.

SoftBank, an investor in Blinkit, was issued shares of Zomato after the company's deal with Blinkit. That deal gave Softbank a 3.35 percent stake in Zomato.

Sources told CNBC-TV18 that investment banks are building a book to capture the demand for Zomato's shares.

Three venture capital firms — Softbank, Sequoia and Tiger Global — had a lock-in period as part of the deal.

Zomato stock: A good opportunity to buy?

Domestic brokerage house JM Financial had suggested in a report that pre-IPO and ex-Blinkit shareholders of Zomato are currently sitting on substantial gains on their investments, a large chunk of which is, however, unrealised.

"Given the quantum of these gains and basis past actions of these VC/PE/Chinese shareholders in the listed internet names that recently went public, we believe it is fair to say that a sizeable proportion of Zomato’s stock could be available for trade in large blocks in a not-so-distant future," the brokerage said.

JM Financial had "strongly" suggested that long-term investors use these liquidity events to build a sizable position in Zomato as it not only offers a strong play on India's online food services market but is also, post the Blinkit acquisition, shaping up into a formidable diversified play on online retail.

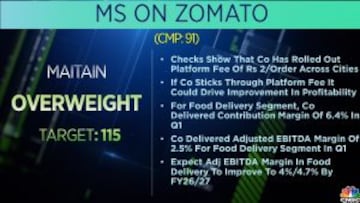

Meanwhile, Morgan Stanley has assigned an 'Overweight' rating to Zomato with a target price of Rs 115, saying checks show that the company has rolled out a platform fee of Rs 2 per order across cities. "If the company sticks through platform fee it could drive improvement in profitability," it said.

Zomato shares opened 2.20 percent higher at Rs 93 apiece on Monday. The stock has rallied 74 percent in the last six months, while it has risen 58 percent in the last year.

First Published: Aug 28, 2023 9:04 AM IST