Zomato shares declined nearly 10 percent in early trade on Wednesday as 66.6 crore shares or 8.4 percent equity worth Rs 3,464 crore changed hands in a series of block deals at an average of Rs 53 per share, 4.6 percent lower than the previous close of Rs 55.60 per share.

The stock, however, recovered from losses soon and was trading 1.08 percent lower at Rs 54.70 per share on BSE at the time of writing.

The fall in Zomato shares comes after the stock gained 20 percent on Tuesday owing to its strong earnings that surprised the Street with a decline in losses as both revenue and cost improved.

Uber Technologies reportedly sold its 7.8 percent stake in Zomato for $392 million. Around 20 global and Indian funds, including Fidelity, Franklin Templeton and ICICI Prudential bought the stake, reported Reuters.

CNBC-TV18 had on Tuesday reported that Uber was likely to sell its 7.8 percent stake in the food delivery company via a big block deal.

Source had told CNBC-TV18 that the offer was of around Rs 2,938 crore or $373 million, with a price range of Rs 48-54 per share. BofA Securities was to be the sole bookrunner for the deal, they said.

Uber made a notional Rs 9,000 crore when Zomato got listed in July 2021. But it didn't sell the shares during the IPO or right after it. Today, the same shares were worth just over a third of that value.

Zomato’s stock price has fallen 2.32 percent in the last one month while it has fallen 60.13 percent this year so far. In the last one year, the stock has underperformed the Sensex by 68.6 percent.

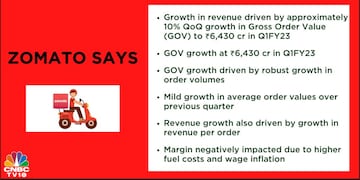

The food delivery aggregator reported a consolidated revenue of Rs 1,1413 crore for the first quarter, sharply up by 67 percent from Rs 844.4 crore reported during the same quarter last year. The revenue was up 16.68 percent on a quarter-on-quarter (QoQ) basis.

The company narrowed its consolidated loss to Rs 185.7 crore in the June quarter compared to Rs 356.2 crore in losses last year and Rs 359.7 crore during the last quarter.

Among the key highlights was the food delivery business reporting break-even. The management aims at break-even on EBITDA or earnings before interest, taxes, depreciation, and amortization latest by the first quarter of next financial year.

“The next milestone is to get the overall Zomato to adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) breakeven. We think we are close now, and in terms of timeline, I think internally we are aiming to get there by fourth quarter of financial year 2023. If we slip on that, it should not be later than Q2FY24, which is September 2023 quarter,” Akshant Goyal, chief financial officer, Zomato, said in an earnings call.

Among the targets set by the company is also to reduce cash burn. As part of earnings announcements, the company said that it has no plans to make any minority investments hereafter as cash is now in conservation mode. Zomato had a cash balance of Rs 11,400 crore as on June 30, 2022.

“...there is no plan to make any more minority investments as we are in cash conservation mode, and are busy executing what we already have on our plates right now,” said CEO Deepinder Goyal in a statement.

The company expects the employee expenses to grow at 15-20 percent every year. It added that the take rates and delivery charges may rise further.

20 percent of the increase in delivery charges is due to rains, said the company on Tuesday, adding that the costs may peak in September 2022.

Going forward, Zomato's focus remains at revenue growth with reduction in losses. The company says it has sharpened focus on operational performance with HyperPure and BlinkIt expected to be future growth drivers.

Zomato had announced the acquisition of quick commerce startup Blinkit in June 2022 for nearly $568 million. It said that the losses in Blinkit are also declining with the July EBITDA loss at Rs 92.9 crore versus Rs 107.7 crore in the previous month.

First Published: Aug 3, 2022 10:06 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Election Commission registers case against BJP's Tejasvi Surya for alleged violation of poll code

Apr 26, 2024 5:08 PM

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 60% voter turnout recorded by 5 pm

Apr 26, 2024 9:11 AM