2023 has been a mixed year for ferrous companies with not much to worry about on the domestic front. But China has been in disarray, which has made the global ferrous industry very nervous. Let's look at some key factors that will drive the performance of the steel market in 2024.

The domestic steel market has been robust this fiscal and the latest World Steel Association outlook suggests that the demand will maintain a good run rate and hit around 136 million tonne in 2024. driven by higher infrastructure spends, and impetus from the government in an election year.

Though domestic demand has been good, steel prices have corrected nearly 6% due to some pressure from the high inventory at the mills and at the distribution channels.

After the recent correction, domestic steel prices have aligned with import parity, a significant change from the 12-13% premium over import prices seen in October 2023. During the third quarter, steel prices showed a downward trend, indicating that average prices for the quarter might remain flat. However, there has been a sequential increase in raw material costs, with iron ore prices rising by approximately 14%, driven by expectations of economic stimulus in China.

Coking coal prices have been hovering around $300 per tonne and are expected to remain high due to weather and labour issues in Australia. Consequently, with steel prices decreasing at the end of the third quarter and raw material costs rising, the profit margins (spreads) in the fourth quarter could face pressure.

The global steel industry, particularly players like Steel Authority of India Ltd (SAIL) and Tata Steel, are facing a significant challenge with the rising cost of coking coal, which is a bigger concern than iron ore prices. Despite being backward integrated, these companies are affected since prices in India are comparatively lower than global rates.

China, as the world's largest steel producer, remains a central focus. The industry is keenly observing whether China has reached its lowest point. Two critical factors will shape the ferrous industry in 2024: Chinese steel exports and the profit margins (spreads) in China's steel market.

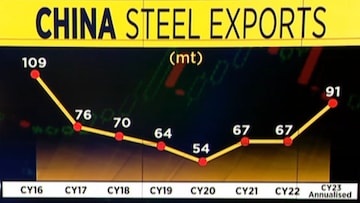

Chinese steel exports have been high, mainly due to the country's weak steel demand, influenced by a sluggish property market. Over the past four months, China's net steel exports have been consistently high, with gross exports reaching eight million tonnes each month. This is 40% higher than the monthly average of approximately 5.5 million tonnes seen in 2021 and 2022. Consequently, China is on track to reach steel exports of about 90 million tonnes, the highest in the last eight years.

The Indian domestic steel market, despite its strength, transitioned to being a net importer of steel starting from July 2023. This shift occurred as Indian steel prices were initially higher than import prices, leading to a competitive disadvantage. However, this price disparity has since been corrected. Furthermore, a significant increase in Chinese steel exports has rendered Indian steel exports less competitive on the global stage, contributing to India's status as a net importer.

While steel import bookings have now begun to slow down, previous bookings may keep the number high at least until January 2024, maintaining some pressure on domestic steel prices.

In China, steel spreads have dropped to about $100 per tonne, a level not seen in the last 13 to 15 years, primarily due to the recent increase in prices of both iron ore and coking coal.

There have been several unsuccessful attempts to revive demand in China's steel market. However, recent initiatives are fostering hope for a positive impact. Currently, with the narrow spreads, many Chinese steel mills are not profitable, leading to expectations that the market has reached its lowest point and will start improving. This anticipated recovery is expected to bolster global steel prices.

For Indian steel companies, the second half of financial year 2024 might be challenging, but there's optimism that China's rebound could enhance steel prices globally. A revival in China's steel market could also lead to a reduction in Chinese steel exports, which would be beneficial for the global ferrous industry, including India.

For more, watch the accompanying video

(Edited by : Shweta Mungre)