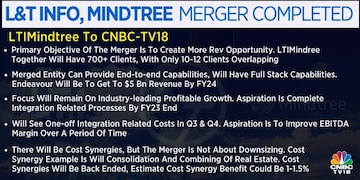

Tech giants Larsen & Toubro Infotech (LTI) and Mindtree have announced their merger to become the fifth-largest firm by market cap of Rs 1.05 lakh crore (approx. $13 billion; $1 = Rs 81) and the sixth-largest IT company by revenue of $4.09 billion. The primary objective of the merger is to create more revenue opportunities by cross-selling and upselling, CEO and Managing Director Debashis Chatterjee told CNBC-TV18 on Tuesday.

LTIMindree will have over 700 clients, with only 10-12 clients overlapping, and the merged entity can provide full stack and other end-to-end capabilities. Chatterjee said the endeavour would be to get to $5 billion in revenue by FY24, and the focus will remain on industry-leading profitable growth.

However, what stock market participants await is whether or not the combined entity will save itself a spot in the Nifty50 index in 2023. Here's what experts and the firm's management say.

How the merger will play out in the stock market?

Mindtree will be delisted from the stock exchanges, and LTI will be rebranded as LTIMindtree from November 24, said Vinit Teredesai, the Chief Financial Officer.

Dipan Mehta, Director at Elixir Equities, said that the major issue with both companies was client concentration, especially with

Mindtree, and that's always a risk factor for a midcap company. Following the merger, client concentration risk factors are likely to be addressed. If the merger entity continues to maintain industry growth rates, investors certainly would like to go overweight on it.

Will LTIMindtree make it to Nifty50?

Analysts at ICICI Securities believe that the merged entity has a high chance of becoming part of the Nifty50 as it meets most of the index’s criteria for the March 2023 review. They added that rules relaxation by MSCI and NSE going forward should also help LTI Mindtree, like in the case of the HDFC-HDFC Bank merger.

However, Nuvama Alternative and Quantitative Research thinks otherwise.

It noted that the record date to identify eligible shareholders for the L&T Infotech and Mindtree merger was announced on November 24. In the next few days, Mindtree (target company) shareholders will get LTI (acquirer) shares, and the overall outstanding shares of LTI will simultaneously increase as per the swap ratio, it said.

According to the existing methodology and the recently floated consultation paper, Nuvama believes LTI sports very few chances to find its way into the Nifty 50 at the Mar-23 review.

“Our stance is that until the merger is completed and fresh shares are credited to the shareholders, the index provider (NSE) will consider LTI an independent entity. With that, Mindtree’s shares/market cap will not be combined in the market cap calculation period (Aug-22 to Jan-23). Hence, the elementary deduction is that LTI’s average market cap will be considered with 26 percent free float,” it explained.

(Free float is the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments.)

The brokerage added that once fresh shares are credited, the free float considered will be 31/32 percent (as indicated by management). It also pointed out that contrary to its stance, the Street is assuming the market cap of both entities for the market cap review period.

Nuvama has pegged 32 percent as free-float with a combined market cap taking into account existing shares from December 1, 2022, till January 31, 2023.

“Even from 15 November 2022 till 31 January 2023, we hypothetically increased the total market cap by 30 percent - yet, LTI stands no chance in replacing BPCL (lowest free-float market-cap contender), at least in the Mar-23 review,” it added.

Therefore, it expects LTI to miss 1.5x free float market cap criteria.

For the stock to qualify, the brokerage highlighted the free-float market capitalisation should be at least 1.5 times the free-float market capitalisation of the smallest constituent in Nifty 50.

If LTIMindtree makes it to Nifty50…

Elixir Equities’ Mehta explained if LTIMindtree finds its way into the various indices, MSCI and Nifty50 as well, then much more money will come into these stocks from ETFs and other institutional investors. He said he was very positive about the combined entity, although there would be some challenges because of macroeconomic headwinds in the US and Europe.

“If you look beyond the next six to eight quarters, then these companies can be fantastic value creators over the long term like a three to five year period,” he said.

He noted that both the companies were clear outperformers versus their peer group and consistently grew at rates of about 15 to 20 percent, even in the last quarter, despite headwinds. They managed to sustain those growth rates, which is quite positive, and therefore they traded at premium valuations.

How Will MSCI Treat The Combined Entity?

MSCI has announced that it will be deleting Mindtree from its indices on November 22, 2022. The record date for the merger with L&T Infotech has been set as November 24, 2022.

Simultaneously, MSCI will increase the weightage of L&T Infotech in the MSCI Standard index. The increase in weightage will be accommodated by Mindtree's deletion.

Shareholders of Mindtree will receive 73 shares of L&T Infotech for every 100 shares that they currently hold.

First Published: Nov 15, 2022 2:18 PM IST