Foreign portfolio investors (FPIs) have had a love-hate relationship with Indian shares thanks to a surge in the dollar as well as the benchmark US bond yield — a combination that makes emerging markets unattractive. Indian equity markets are yet to revisit their lifetime highs of October 2021, which saw the last of a liquidity-driven run to historic levels that lasted 18-odd months.

This at a time when globally, experts are staring at a "superbubble" on Wall Street.

Analysts believe it may not be as easy for FPIs to return to the Indian market as it is to make a sudden exit given the unfavourable conditions. N Jayakumar, MD at Prime Securities, describes the current situation in the Indian market "a chakravyuh moment".

In an interaction with CNBC-TV18, he said: "In the Mahabharata, the fight that Abhimanyu was having made him get into a formation called the 'chakravyuh' and he couldn't get out of it. I think the comparison with it, while it may sound far fetched, is exactly this."

"Now as the dust is settling, and some of them want to come in (after months of selling), the first $5 billion has created a move from 15,000 to 17,500 on the Nifty. It is a 'chakravyuh' moment because they've been able to exit but a reentry of the same parameters is going to be next to impossible," he explained.

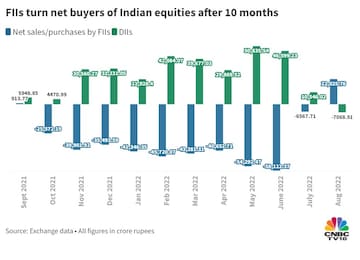

FPIs emerged net buyers of Indian shares in August — the first month of net inflows for Dalal Street since September 2021. Their net purchases came to about Rs 22,026 crore, according to provisional exchange data.

They made a sharp U-turn at least on the first day of September 2022, pulling out Rs 2,290 crore worth of shares.

In such a scenario re-entering Indian equities may not always be as easy as exiting, say experts.

"It is clear in market trends since October 2021 exit is easy for FIIs but entry difficult and expensive," VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, told CNBCTV18.com.

But that may not mean a complete reversal after sustained buying in August.

"The situation can change fast based on the Fed's take on interest rates. Inflation appears to be declining and it is quite possible that Fed will not be ultra hawkish in action as it has been in words. A declining dollar index can again turn the situation favourable for capital flows to emerging markets," Vijayakumar said.

The dollar index — which measures the US dollar against the Japanese yen, the British pound, the Euro, the Swiss franc, the Canadian dollar and the Swedish krona — is a stone's throw from 109.99, its highest intraday level recorded in the past 20 years.

The impact of a strengthening dollar can be seen in the rupee's plunge to an all-time low of 80.08 on August 29.

So what is the 'chakravyuh' all about?

Given such volatile times in the dollar — which is often considered a safety bet just like gold, a foreign institutional investor may not get an opportunity to reenter India at the same level of valuation at which an exit was made.

Many experts have already warned against roaring valuations in the Indian market.

Indian equity benchmarks have escaped what experts were not so soon ago calling one of the slowest bear markets of all time.

Jayakumar is of the view Dalal Street could be entering a period of significantly more expensive valuations "before a buying frenzy".

Hedge fund manager and value investor Jeremy Grantham believes the US market remains "very expensive".

The kind of increase in inflation in the world's largest economy, like the one this year, has always hurt multiples although more slowly than normal this time, according to Grantham, who believes the current "superbubble" in the US features:

"But now the fundamentals have also started to deteriorate enormously and surprisingly: between COVID in China, war in Europe, food and energy crises, record fiscal tightening, and more, the outlook is far grimmer than could have been foreseen in January," Grantham, Co-Founder and Long-Term Investment Strategist of GMO, wrote in a note dated August 31.

"(In the) longer term, a broad and permanent food and resource shortage is threatening, all made worse by accelerating climate damage," he added.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM