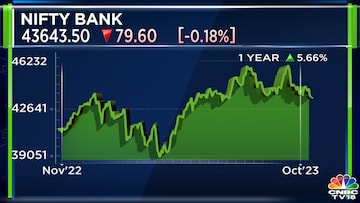

The Nifty 50, the benchmark index for blue chip stocks in India, is down about 3% from its recent high on September 15. Whereas, the Nifty Bank, the benchmark index for India's biggest banking stocks, is down over 5% in the same period.

If Laurence Balanco, Technical Analyst at CLSA, is to be believed the banking stocks may drag the market even lower, by another 5%, from hereon. "The recent price action exhibits signs of relative and absolute vulnerability," he said in a conversation with CNBC-TV18 on Monday (October 23).

Balanco is a technical analyst who reads charts and identifies patterns that can predict future movements. He cited the recent 'double top' formed on the Nifty Bank charts, which is supposed to be a bearish pattern that is followed by a sharper correction.

"If you look at the Nifty Banks Index, you will see a double-top pattern. So, there is another 5% downside risk and that is the likely sector to take the market back to at least at 19,100 area," he said.

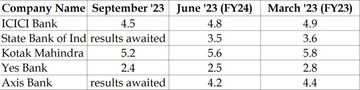

Overall, banks have had a good year in terms of earnings. ICICI Bank, Kotak Mahindra Bank and HDFC Bank beat some market estimates on the earnings. However, there have been some reasons for concern recently. Interest rates are rising, and so is the competition for low-cost deposits.

Also Read

This wouldn't be a problem if the credit growth was just as fast, if not better. However, capital investments by companies have slowed down and that has led to a slowdown in demand for loans from corporates too. All of these factors together, have led to the shrinking of margins for the lenders.

Below are the NIMs of some top banks (data from Bloomberg)

In a note released on October 19, broking firm Motilal Oswal pointed out that corporate debt grew a mere 3.9% between June and September 2023, compared to the same time last year.

This was almost as weak as the 2.7% growth seen in January to March 2023. To put it in perspective, the growth in corporate debt in India was 10.8% at the same time last year. "This weakness in corporate debt is in line with the dip in corporate investments," according to the Motilal note.

When corporations reduce their investments, they also tend to borrow less from banks. And, companies have cut back on investments for two quarters in a row.

(with input from MOFSL)

For more details, watch the accompanying video

(Edited by : Sriram Iyer)

First Published: Oct 23, 2023 4:20 PM IST