Shares of Vodafone Idea Ltd (VIL) slipped in the red in Wednesday's trade as investors on Dalal Street continued to express skepticism despite the approval of a ₹45,000-crore fundraising plan. The approved fundraising initiative includes raising up to ₹20,000 crore through a combination of equity and equity-linked instruments, with the remainder to be sourced via debt, and active participation from promoters in the proposed equity raise.

Over the last one year, the Vodafone Idea stock’s value has more than tripled, but for a major re-rating of the stock, fundraising is critical.

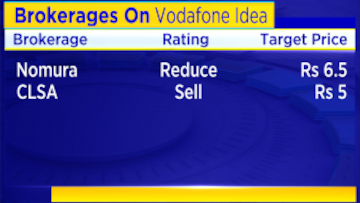

Following the development, global brokerage firm Nomura said that a change of fortunes is now on the cards. The brokerage has assigned a 'Reduce' rating on the

Vodafone Idea stock, saying if the telecom operator manages to bring in external investors, that would be a significant positive.

Nomura has a share price target of ₹6.5 on the counter. This suggests a downside of 60% from the stock's current market levels. On Tuesday, VIL shares settled 4.45% lower at ₹16.10 apiece on NSE. The stock has gained 10% in the last one month.

The foreign brokerage firm also said that the fundraising of up to ₹45,000 crore will enable 5G rollout and an improvement in operational performance. Also, repair, recovery and rolling out 5G will be key monitorables after the company secures funding, it said.

With regards to the telecom sector, Morgan Stanley said if Vodafone Idea's fund raise closes, current market structure is likely to continue near-term.

Meanwhile, CLSA expects a financial crunch in FY26CL when annual spectrum and AGR payments will be due. The brokerage has a 'Sell' call on the counter with a target price of ₹5 per share.

'Vodafone Idea is missing the boat on 5G'

Speaking to CNBC-TV18, Nitin Soni, Sr Director- Corporate Ratings at Fitch Ratings said, "We have seen that Vodafone idea is looking to raise funds in the market but they haven't been successful. They have been trying to raise funds from the last one or two years. This announcement is good. I mean they need money definitely, they haven't launched 5G while both Bharti and Reliance Jio already have launched 5G and adding 5G subscribers and to me it feels like Vodafone Idea is missing the boat on 5G and they could actually lose more customers because they haven't launched 5G yet."

"So even if they are successful in raising this kind of money ₹45,000 crore, it will still take up some time for them to launch 5G and compete effectively in the market. And they continue to lose subscribers about 1-2 million subscribers every month to Jio or Bharti Airtel," Soni added.

On the financial front, VIL's average revenue per user (ARPU) has increased to 145 in the last quarter, but it's still well below Bharti and Jio subscribers. "So they definitely need to raise a large sum of money to launch 5G and to augment their capex, which they haven't been doing much otherwise the customer churn will increase going forward," Soni stated.

VIL said it will call for a meeting of its shareholders on April 2 this year and post-shareholder approval it expects to complete the equity fund raise in the coming quarter.

The company said it will continue to be engaged with its lenders for tying-up the debt funding after the equity fund raise. Through a combination of equity and debt, Vodafone Idea plans to raise around ₹45,000 crore. The telco said its bank debt currently stands at less than ₹4,500 crore.

The fundraise will enable Vodafone Idea to make investments towards

expansion of 4G coverage, 5G network rollout and capacity expansion. These investments will also enable the company to improve its competitive positioning and offer an even better customer experience, said the company on Tuesday.

First Published: Feb 28, 2024 9:11 AM IST