In 2008, the earnings yield on the S&P 500 dropped to 0.8%. US 10-year bonds then offered a yield of over 2.8%, suggesting a spread of 200 basis points. If you had jumped out of stocks into bonds then, you would have cursed yourself. Because by 2012, stocks had gained over 70% and were still available at a yield of well over 6%, while the yields on bonds were still near 2.2%.

This was because a sharp drop in earnings led to a big dip in yields, but a swift recovery led to a big leap in profits driving yields sharply down. It was during this period that the price-to-earnings (PE) of the S&P 500 hit a peak of over 120 times before plunging to nearly 13 times. This, of course, was an exceptional period, but it pays to keep this phenomenon in mind.

S&P 500 Price and Price to Earnings Ratio

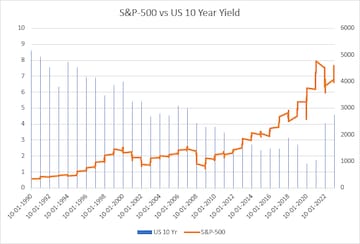

S&P 500 Price and Price to Earnings RatioBut let’s take a closer look at how the S&P 500 and US bond yields have behaved.

YIELDS AND EQUITIES DO BOND

US bond yields and equities do tend to influence each other to an extent. A look at the correlation between US 10-year bond yields and the S&P 500 since 1990 reveals a moderate negative correlation of 0.67. What this suggests is that when bond yields rise, there is a likelihood that equity valuations may be negatively impacted. So, the common refrain of investors moving money from equities to bonds when yields rise does have some empirical basis.

That said, should you be worried when bond yields surpass equity earnings yields?

S&P 500 versus US 10-year Treasury bond yield

S&P 500 versus US 10-year Treasury bond yieldTHE EQUITY-BOND YIELD EQUATION

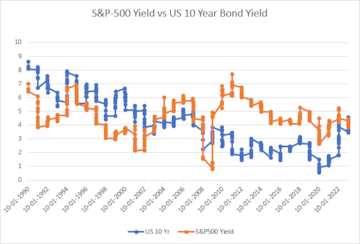

Many are pointing to the surge in the US yields and its surpassing earnings yield on equities as a significant development. Some are suggesting this could have ominous consequences.

True, the development is significant because US earnings yields have remained well above the US 10-year bond yield since 2003. That’s a good 20-year phenomenon. But during the period from 1994 to 2002, US bond yields traded above the earnings yield. We looked at both these periods for pointers to what could transpire.

Interestingly, in 1994, the earnings yield spread over the 10-year bond yield was a negative 90 basis points. In 2002, it was a negative 70 basis points. In 1994, the 10-year bond offered a yield of 5.65% and the S&P 500 over the period delivered a compounded annual growth rate (CAGR) of 7.8%. So, while the spread was negative, it wasn’t as if equities didn’t offer any returns, but one could argue that the differential in returns didn’t justify the risk of being in equities.

What’s also interesting is that during this period, the PE increased at a CAGR of 5.2%, suggesting a lower contribution from earnings growth than PE expansion.

In contrast, during the post-financial crisis period starting in 2010, when the earnings yield spread was a positive 200 basis points, equities delivered a CAGR of over 11% with only a 2.5% CAGR in PE. This suggests strong returns compared to the then bond yield of 3.9%.

Clearly, buying into equities when the yield was an attractive 5.7% also helped generate attractive returns—given the average yield of 4.5% and a median yield of 4.4%. So, buying into equities when spreads are positive is a good idea, but that itself isn’t good enough.

S&P 500 Yield vs US 10-year Treasure bond yield

S&P 500 Yield vs US 10-year Treasure bond yieldTHE IMPONDERABLES

It is important to appreciate that bond yields and earnings are both dynamic, moving numbers and basing investment decisions purely on yield differentials isn’t a sound strategy. Also important to understand is what parameters you are comparing. If you consider yields on a 10-year US bond, you are looking at fixed returns over a long period. Hence, looking at earnings yield for just the next four quarters may not be a fair like-to-like comparison. What if there is an acceleration in earnings during the period? That can make the yield on the discounted value look much more attractive.

In the present context, while undoubtedly buying into bonds does seem like a good idea to lock into yields near 5%, assuming interest rates don’t go much higher, a softer-than-expected economic landing—averting a recession—could also spell an upward revision in earnings estimates, altering the yield differential.

With earnings yield for the S&P 500 presently a tad below historical mean and median levels, a further dip in equities could throw up opportunities for investments in growth stocks for discerning investors. So, buy bonds for sure, but don’t give up on equities because the yields could change quite swiftly if things go right. Also, an inversion in yield spreads doesn’t necessarily signal a slide in equity values—we’ve lived through this before.

(Edited by : Shweta Mungre)

First Published: Oct 22, 2023 3:20 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi to contest from Varanasi, to file nomination papers on May 14

May 5, 2024 2:49 PM

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM