After gaining for three consecutive days, shares of UPL tanked more than 5 percent on Tuesday, and were the biggest drag on the Nifty 50 index, despite the company reporting strong earnings and guidance. Further, CLSA cut its target price on the stock.

At 12:41 IST, shares of the company were trading 3.9 percent lower at Rs 739.85 on the BSE.

Investors lost Rs 3,002.7 crore in wealth in a day as the market capitalisation of UPL came down to Rs 56,524.08 crore at the intraday low of Rs 730.20.

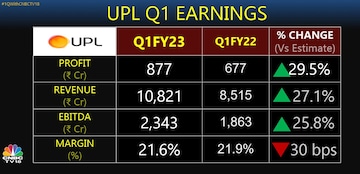

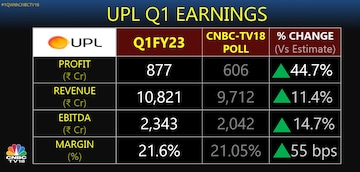

Here are the financials of the agrochemicals company:

Revenue growth came on the back of better product realisations, favourable exchange rate, and higher volumes.

Jai Shroff, Chief Executive Officer, UPL, said the company continued to see solid growth momentum in the first quarter of FY23, as the strong agri commodity prices drove significant uptick in price realisations as well as healthy demand from growers.

He said the EBITDA (earnings before interest, taxes, depreciation, and amortisation) margin remained largely intact despite the significant input cost inflation and a challenging macro-economic environment exacerbated by geopolitical issues.

"This was driven by proactive pricing actions coupled with efficient supply chain management that led to the strong topline growth getting translated into robust operating profitability growth as well,” Shroff said.

Management outlook

For the rest of the year, UPL believes it is well-poised to continue its healthy growth momentum, as product realisations continue to remain strong, recent new launches continue to see good traction in the marketplace, and the overall demand outlook continues to be constructive.

“Considering this positive outlook, we have revised our FY23 guidance upwards, expecting to achieve a revenue growth of 12-15 percent now versus 10 percent earlier, and EBITDA growth of 15-18 percent versus 12-15 percent earlier,” UPL said in its earnings press release.

What brokerage firms say

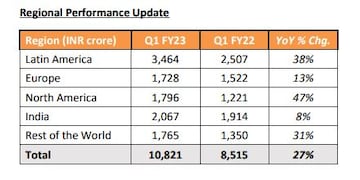

CLSA noted that first quarter earnings were ahead of estimates with all geographies reporting revenue above forecasts, except India.

UPL's revenue growth across geographies

UPL's revenue growth across geographiesEven as the global brokerage firm has a ‘buy’ recommendation on the stock, it has slashed target price on the stock to Rs 1,000 from Rs 1,100.

The company has reduced its net debt while raising growth guidance for revenue and EBITDA for FY23, which are key positives.

CLSA said that tangible debt reduction was the most important lever for the rerating of the stock. However, the brokerage firm has lowered its earnings estimate by 206 percent to factor in higher interest costs.

First Published: Aug 2, 2022 1:36 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court dismisses plea seeking postponement of CA exams; details here

Apr 29, 2024 2:29 PM

Just 8% women candidates contested first two phases of Lok Sabha polls

Apr 29, 2024 12:00 PM

The sexual assault case against Prajwal Revanna — here's what we know so far

Apr 29, 2024 11:36 AM

Repolling underway at one polling booth in Chamarajanagar LS segment in Karnataka

Apr 29, 2024 10:32 AM