UPL Ltd. shares are the top losers on the Nifty 50 index after the company reported a wider-than-expected loss in the December quarter. The stock, after its 7.5% drop is the top loser on the Nifty 50 index.

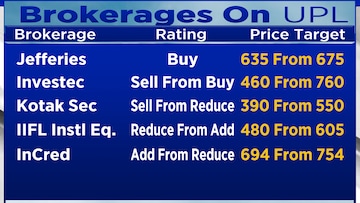

Brokerage firm Jefferies has maintained its "buy" recommendation on UPL but cut its price target to ₹635 from ₹675 earlier. Even the revised price target implies a potential upside of 20% from Friday's close.

Along with its price target, Jefferies has also cut UPL's earnings per share (EPS) estimates for the financial year 2025 and 2026 by 13% and 15% respectively, while also anticipating a loss in the financial year 2024.

However, it believes that the company's deleveraging targets are healthy as it explores capital-raising plans, including a rights issue.

DAM Capital though, has downgraded UPL to "sell" with a price target of ₹462, saying that UPL's realisations continue to remain under significant pressure. This, combined with high-cost inventory liquidation with higher rebate levels led to significant negative value growth and gross margin compression.

Brokerage firm Nuvama has also downgraded the stock to reduce and cut its price target to ₹486 from the earlier target of ₹718. It sees the risk of credit rating downgrades and pressure on UPL's balance sheet going forward. It has also cut UPL's target multiple to 11 times from 13 times earlier.

On the flip side, InCred advises investors to buy UPL aggressively on dips, and has upgraded the stock to "add" with a price target of ₹694. It said that agrochemical majors are being hit hard by channel inventory and that UPL is doing the right thing by not increasing its receivables and saving its vendors.

It is valuing UPL at 20 times the financial year 2026 price-to-earnings but said that the stock remains volatile at the cusp of a cycle change.

Out of the 32 analysts that track UPL, five of them so far have a "sell" or an equivalent rating on the stock, while 21 continue to maintain a "buy" recommendation.

Shares of UPL are down 8.1% to ₹490.7. The stock is trading at the lowest levels in nearly three years.

First Published: Feb 5, 2024 11:00 AM IST