When the Finance Minister made her tax announcements, the Nifty 50 was trading in the positive territory. A few minutes after she commended the Union Budget 2023 to the house, the index made an intraday high of 17,972.

It appeared that the street has taken to the Budget speech in a positive manner. A few minutes later, the index fell, and fell off a cliff. The day's high of 17,972 soon turned into the day's low of 17,356 - A 600-point drop in a few minutes.

The lows of the day were the lowest intraday levels since August last year.

However, both Sensex and the Nifty 50 recovered as swiftly as they fell from the day's high. While the Sensex ended 160 points higher, the Nifty 50 recovered more than 250 points from the day's low to end 45 points lower.

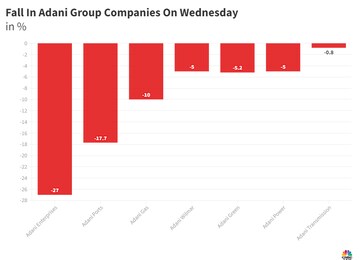

A couple of factors soured sentiment across the street. First came the Adani Group companies, which looked to have some semblance of normalcy at the start of trade, but soon went back to their respective lower circuits.

The drop was triggered by a Bloomberg report, which said that Credit Suisse has stopped accepting bonds of the Adani Group companies as collateral for margin loans to its private banking clients.

Credit Suisse’s private banking arm has assigned a zero lending value for notes sold by Adani Ports and Special Economic Zone, Adani Green Energy and Adani Electricity Mumbai Ltd., Bloomberg reported quoting people familiar with the matter.

As a result, Adani Wilmar, Adani Power and Adani Gas ended at their respective lower circuits of 5 percent and 10 percent respectively. The bigger casualty was Adani Enterprises, which ended 26 percent lower. The stock is now Rs 1,100 below its FPO price of Rs 3,276. Adani Ports also ended 18 percent lower.

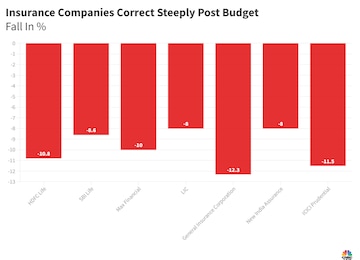

Another sector that was the worst hit was Insurance. Finance Minister Nirmala Sitharaman in her budget speech proposed to take away the tax free advantage from traditional insurance plans issued on or after April 1, 2023 whose annual premium is over Rs 5 lakh. However, this won't impact taxation of Unit-Linked Insurance plans.

Shares of HDFC Life and SBI Life declined 10 percent and 9 percent respectively, marking their worst single day drop in three years.

Market experts believe that the correction is an opportunity to buy.

Nilesh Shah of Envision Capital said that the current levels are looking very attractive and attributed the current volatility to a certain section of the stocks which are now impacting the broader market.

Sandeep Bhatia of Macquarie believes that while he does not pencil in a steep correction for the Indian market, he would welcome one as it would be a fantastic opportunity to buy. "I think the budget is a better than expected budget primarily for the fact that tax rates across all income categories for the first time this government has cut and that is a good in principle signal that wealth creation and wealth creators will be rewarded in this country," he said.

Foreign investors are putting money into China, according to Gautam Trivedi of Napean Capital. He attributed this to the Hang Seng rallying 53 percent from the lows of November. "Hong Kong is the fourth largest market in the world ahead of India in terms of total marketcap. So, the profits are getting booked here and money is going to those two markets," he said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | What does a low voter turnout indicate for NDA and I.N.D.I.A Bloc

Apr 29, 2024 5:48 AM

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM