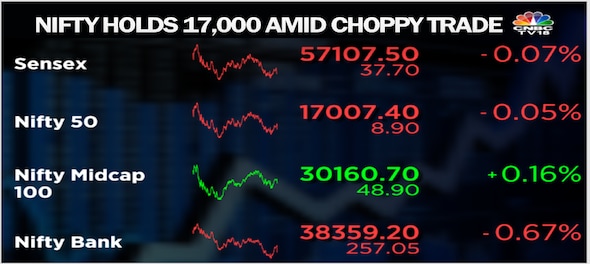

Indian equity benchmarks recovered most of the intraday losses in a choppy session on Tuesday, aided by gains in heavyweights such as Reliance, TCS and Infosys, and in healthcare stocks. Losses in financial stocks such as the HDFC twins, SBI and ICICI Bank, however, came in the way of the headline indices finishing the day in the green.

Investors awaited the outcome of a key meeting of the RBI's rate-setting panel due later this week for domestic cues.

What do the charts suggest for Dalal Street?

The Nifty50 has formed a reasonable negative candle on the daily chart following a similar one in the previous session, suggesting more of rangebound action ahead with a weak bias, according to Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

"The pattern indicates lack of strength in the intraday bounce. This is not a good sign and one may expect further weakness in the short term," he said.

More downside likely in banking basket

The Nifty Bank's slide below the previous session's low and below its 50-day exponential moving average has turned the sentiment negative, said Rupak De, Senior Technical Analyst at LKP Securities.

"The momentum indicator is in a bearish crossover. The trend looks negative," he said.

Here are key things to know about the market ahead of the September 28 session:

SGX Nifty

On Wednesday, Singapore Exchange (SGX) Nifty futures — an early indicator of the Nifty50 index — fell as much as 195.5 points or 1.1 percent to 16,859.5 ahead of the opening bell on Dalal Street.

Global markets

Equities in other Asian markets began the day in the red, following a mixed session overnight on Wall Street, amid worries about aggressive policy tightening by the Fed and its potential impact on economic growth. MSCI's broadest index of Asia Pacific shares outside Japan was down 1.4 percent in early hours.

Japan's Nikkei 225 was down 2.2 percent, China's Shanghai Composite 0.6 percent and Hong Kong's Hang Seng 1.8 percent.

S&P 500 futures were down 0.6 percent. On Tuesday, the three main US indices finished on a mixed note, with the S&P 500 and the Dow Jones falling 0.2 percent and 0.4 percent respectively, and the tech stocks-heavy Nasdaq Composite ending 0.3 percent higher.

What to expect on Dalal Street?

HDFC Securities' Shetti believes the Nifty50 has temporary halted weakness near crucial support at 16,800 and faces immediate resistance around the 17,150-17,200 zone.

"The area of 16,800 has acted as an important area and resulted in significant movement in the past... There is a possibility of a sustainable bounce in the market from near this support," he said.

De of LKP is of the view that a slide in the banking index below 38,000 may lead to 37,700-37,500 levels. "Higher-end resistance is visible at 38,800-39,000," he said.

Key moving averages

The Nifty continues to be 3.6 percent below its long-term simple moving average in a bearish signal.

| Period (No. of sessions) | SMA |

| 5 | 17,039.1 |

| 10 | 17,036.3 |

| 20 | 17,110.9 |

| 50 | 17,463.9 |

| 100 | 17,666.3 |

| 200 | 17,635.8 |

FII/DII activity

Foreign institutional investors (FIIs) remained net sellers of Indian shares for the fifth trading day in a row on Tuesday, pulling out Rs 2,824 crore from Dalal Street, according to provisional exchange data.

In August, they made net purchases to the tune of Rs 22,025.8 crore — the first month of net inflows after 10 straight months of outflows, whereas domestic institutional investors (DIIs) net sold shares worth Rs 7,068.9 crore.

ALSO READ: 'Chakravyuh' moment in Indian market

Call/put open interest

The maximum call open interest is accumulated at the strike prices of 18,000 and 17,500, with 1.7 lakh contracts each, and the next highest at 17,600 and 17,700, with 1.4 lakh contracts each, according to exchange data.

On the other hand, the maximum put open interest is at 16,000 and 16,500, with 1.2 lakh contracts each, and at 17,000, with 1.1 lakh.

This suggests a strong base after the 17,000 mark at 16,500, and a tough hurdle at 17,500.

Long build-up

Here are five stocks that saw an increase in open interest as well as price:

| Stock | Current OI | CMP | Price change | OI change |

| CIPLA | 5,070,000 | 1,096.15 | 3.03% | 39.68% |

| PIIND | 1,082,500 | 3,025.45 | 0.71% | 22.03% |

| TORNTPOWER | 3,439,500 | 508.7 | 2.58% | 21.28% |

| COLPAL | 1,921,850 | 1,578.70 | 0.63% | 20.72% |

| NAUKRI | 979,375 | 3,910.80 | 5.08% | 18.86% |

Long unwinding

| Stock | Current OI | CMP | Price change | OI change |

| IBULHSGFIN | 13,576,000 | 114 | -3.68% | -28.99% |

| FSL | 11,180,000 | 102.85 | -1.11% | -27.26% |

| CANFINHOME | 2,796,300 | 462 | -3.15% | -25.07% |

| JSWSTEEL | 16,676,550 | 640.9 | -0.68% | -19.67% |

| SRTRANSFIN | 2,894,400 | 1,170.50 | -0.54% | -19.01% |

(Increase in price and decrease in open interest)

Short covering

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| AMARAJABAT | 3,315,000 | 489.2 | 0.97% | -26.24% |

| INTELLECT | 1,182,750 | 538.25 | 0.43% | -22.95% |

| ESCORTS | 1,025,200 | 2,041.05 | 2.03% | -21.30% |

| GUJGASLTD | 4,062,500 | 519 | 6.98% | -20.95% |

| ABFRL | 6,676,800 | 322 | 1.32% | -20.72% |

(Increase in price and decrease in open interest)

Short build-up

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| ATUL | 148,800 | 8,915.90 | -0.36% | 28.02% |

| APOLLOHOSP | 973,750 | 4,252.90 | -0.81% | 27.06% |

| SBILIFE | 4,647,000 | 1,244 | -1.14% | 24.24% |

| MARUTI | 2,837,500 | 8,771.25 | -0.63% | 21.77% |

| SIEMENS | 1,260,600 | 2,722.35 | -1.63% | 20.90% |

(Decrease in price and increase in open interest)

52-week highs

Two stocks in the BSE 500 universe — the broadest index on the bourse — scaled the milestone: Cipla and Metro Brands.

52-week lows

On the flipside, 15 stocks hit 52-week lows:

| ALOKTEXT | GRAPHITE | NATCOPHARM |

| APLLTD | IEX | SHILPAMED |

| AUROPHARMA | JCHAC | SONACOMS |

| BIOCON | LICI | SUVENPHAR |

| GLAND | MASTEK | SYMPHONY |

First Published: Sept 27, 2022 9:21 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Deve Gowda's son-in-law Manjunath to lock horns with Congress' DK Suresh

Apr 26, 2024 9:11 AM