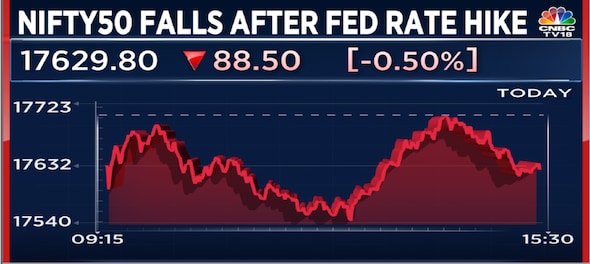

Indian equity benchmarks extended losses to a second straight session on Thursday amid weakness across global markets, after the US Federal Reserve announced a widely-expected 75-basis-point hike in the key interest rate — a third such back-to-back increase.

Fed Chair Jerome Powell vowed to "keep at" the US central bank's battle to beat down red-hot inflation and said there is no painless way to bring down inflation.

What do the charts suggest for Dalal Street?

The Nifty50 has formed a small positive candle on the daily chart, with upper and lower shadows, suggesting the making of a high wave-type pattern, according to Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

One can expect the 50-scrip index to bounce back in the short term, he said.

Time to sell the rise in banking

It is an opportune time to sell the rise in the Nifty Bank as long as it remains below 42,000, according to Kunal Shah, Senior Technical Analyst at LKP Securities.

He believes a breach below 40,500 will open the gates for further downside towards 39,000. A break on either side in the 40,000-42,000 range will give a directional move, Shah said.

Here are key things to know about the market ahead of the September 23 session:

SGX Nifty

On Friday, Singapore Exchange (SGX) Nifty futures — an early indicator of the Nifty index — fell as much as 83.5 points or 0.5 percent to 17,556.5 ahead of the opening bell on Dalal Street.

Global markets

Equities in other Asian markets began Friday with losses, though of smaller magnitude than the previous day, as investors reacted to the Fed's latest moves to rein in the pace of rising consumer prices. MSCI's broadest index of Asia Pacific shares outside Japan was down 0.4 percent at the last count.

Hong Kong's Hang Seng and China's Shanghai Composite were down 0.3 percent each. The Japanese market was shut for a holiday.

S&P 500 futures were flat. On Thursday, the three main US indices continued to fall for a third straight day amid selling pressure in tech and other growth stocks. The S&P 500 fell 0.8 percent, the Dow Jones 0.4 percent and the Nasdaq Composite 1.4 percent.

What to expect on Dalal Street?

HDFC Securities' Shetti believes a bounce is likely in the Nifty, though its short-term continues to be choppy.

He sees immediate support for the index at 17,530 and resistance at 17,750 levels.

Mohit Nigam, Head-PMS at Hem Securities, identified the following levels to watch out for:

| Index | Support | Resistance |

| Nifty50 | 17,400 | 17,800 |

| Nifty Bank | 40,000 | 41,000 |

Key moving averages

In a bearish signal, the Nifty remains below all six of its simple moving averages.

| Period (No. of sessions) | SMA |

| 5 | 17,631.3 |

| 10 | 17,644.9 |

| 20 | 17,720.4 |

| 50 | 17,744.7 |

| 100 | 17,797.1 |

| 200 | 17,706.7 |

FII/DII activity

Foreign institutional investors (FIIs) remained net sellers of Indian shares for a second straight day on Thursday.

In August, they made net purchases to the tune of Rs 22,025.8 crore — the first month of net inflows after 10 straight months of outflows, whereas domestic institutional investors (DIIs) net sold shares worth Rs 7,068.9 crore.

ALSO READ: 'Chakravyuh' moment in Indian market

Call/put open interest

The maximum call open interest is accumulated at the strike price of 18,000, with 1.8 lakh contracts, and the next highest at 17,700 and 17,800, with more than one lakh each, according to exchange data.

On the other hand, the maximum put open interest is at 17,600, with 1.7 lakh contracts, and at 17,500, with one lakh contracts.

This suggests a strong hurdle stays at the 18,000 mark and a strong base exists at 17,600.

Long build-up

Here are five stocks that saw an increase in open interest as well as price:

| Stock | Current OI | CMP | Price change | OI change |

| BHARATFORG | 6,647,000 | 786.5 | 2.92% | 11.85% |

| GNFC | 5,397,600 | 697.1 | 2.06% | 8.69% |

| TVSMOTOR | 6,680,800 | 1,075.10 | 0.41% | 7.54% |

| PAGEIND | 102,540 | 53,320 | 4.28% | 6.82% |

| LTTS | 872,400 | 3,494.05 | 1.30% | 6.58% |

Long unwinding

| Stock | Current OI | CMP | Price change | OI change |

| CANFINHOME | 4,633,200 | 543.3 | -1.64% | -6.38% |

| AUBANK | 5,447,000 | 665.15 | -0.48% | -4.94% |

| SBICARD | 4,314,400 | 947.85 | -0.35% | -3.23% |

| ABCAPITAL | 23,085,000 | 116.05 | -1.19% | -3.02% |

| GSPL | 4,470,000 | 241.25 | -0.31% | -2.85% |

(Increase in price and decrease in open interest)

Short covering

| Stock | Current OI | CMP | Price change | OI change |

| SAIL | 88,026,000 | 80.8 | 0.69% | -5.28% |

| RECLTD | 31,824,000 | 104 | 1.12% | -4.75% |

| ABFRL | 9,243,000 | 345.7 | 0.86% | -3.99% |

| HINDCOPPER | 18,447,000 | 116.95 | 1.26% | -3.66% |

| ESCORTS | 1,309,000 | 2,120.05 | 2.08% | -3.49% |

(Increase in price and decrease in open interest)

Short build-up

| Stock | Current OI | CMP | Price change | OI change |

| HONAUT | 17,130 | 40,959.95 | -1.07% | 8.58% |

| CUB | 8,485,000 | 180.35 | -3.63% | 6.42% |

| ASTRAL | 1,083,500 | 2,350 | -0.43% | 6.29% |

| LT | 8,523,300 | 1,897.40 | -0.22% | 5.79% |

| UBL | 1,076,400 | 1,649 | -1.24% | 5.72% |

(Decrease in price and increase in open interest)

52-week highs

A total of 11 stocks from the BSE 500 universe — the broadest index on the bourse — reached the milestone: ITC, Maruti Suzuki, Page Industries, Patanjali Foods, Cochin Shipyard, KRBL, Lakshmi Machine, Rhi Magnesita, Varun Beverages, Welspun and Lemontree.

52-week lows

An equal number of stocks hit 52-week lows: LIC, Infosys, Indian Oil, IEX, Biocon, Mastek, Medplus Health, Sanofi, SIS, Sona BLW and Zensar.

First Published: Sept 22, 2022 7:32 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM