Indian equity benchmarks finished a volatile session on a flat note on Friday to halt a two-day winning run, but managed to recover most of their intraday losses aided by a fag-end rebound led by heavyweights such as Reliance, Titan, HDFC and Bharti Airtel. Globally, concerns about steep rate hikes hampering economic growth kept investors nervous.

What do the charts suggest for Dalal Street?

The Nifty50 has formed a small positive candle on the daily chart with upper and lower shadows, according to Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Its occurrence after weakness at 17,425 suggests an attempt to retest the hurdle in the near term, he said.

Time to buy the dip in Nifty Bank

The banking index has been finding support around its 20-day exponential moving average on the weekly chart in a positive sign, Sameet Chavan, Chief Analyst-Technical and Derivatives at Angel One, told CNBCTV18.com.

He remains upbeat on the banking space and continues to advocate buying on declines in the short term.

Here are key things to know about the market ahead of the October 10 session:

SGX Nifty

On Monday, Singapore Exchange (SGX) Nifty futures — an early indicator of the Nifty index — fell as much as 299.5 points or 1.7 percent to 17,014.5 ahead of the opening bell on Dalal Street.

Global markets

Equities in other Asian markets largely fell amid thin trade following a plunge on Wall Street last Friday, as strong growth in US jobs strengthened the case for the Fed to keep raising interest rates aggressively in its fight to control high inflation. MSCI's broadest index of Asia Pacific shares outside Japan was down one percent at the last count.

China's Shanghai Composite was down 0.1 percent and Hong Kong's Hang Seng down 2.2 percent. The Japanese market was shut for a holiday.

S&P 500 futures were down 0.4 percent. On Friday, the S&P 500 fell 2.8 percent, the Dow Jones 2.1 percent and the Nasdaq Composite 3.8 percent. Earlier that day, the pan-European Stoxx 600 index finished 1.2 percent lower.

What to expect on Dalal Street?

HDFC Securities' Shetti believes the Nifty50 continues to be in an uptrend. He expects some more consolidation in the market.

"A decisive breakout of the 17,450 hurdle is likely to pull the Nifty towards another important resistance at 18,000-18,100 levels. Immediate support is placed at 17,200," he said.

Key moving averages

The Nifty50 stands one percent below its long-term moving average.

| Period (No. of sessions) | Simple moving average | |

| Nifty50 | Nifty Bank | |

| 5 | 17,286.1 | 39,018.2 |

| 10 | 17,287.6 | 39,038.5 |

| 20 | 17,311.7 | 39,166.7 |

| 50 | 17,114.6 | 38,598.8 |

| 100 | 17,239.3 | 39,160.3 |

| 200 | 17,507.9 | 39,800.5 |

Chavan expects key support for the Nifty Bank at 38,800-38,600 levels and immediate resistance at 39,600 followed by 40,000.

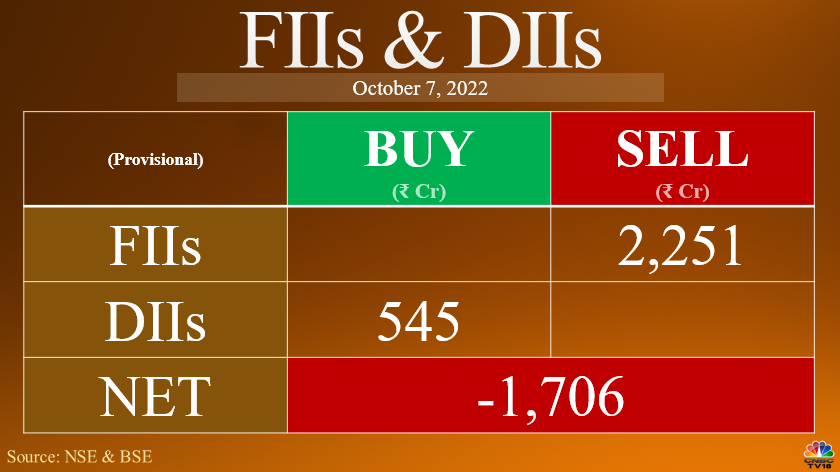

FII/DII activity

Foreign institutional investors (FIIs) emerged net sellers of Indian shares on Friday after three back-to-back trading days of buying, according to provisional exchange data.

Long build-up

Here are five stocks that saw an increase in open interest as well as price:

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| DELTACORP | 15,138,600 | 228.35 | 3% | 9.80% |

| TITAN | 5,032,500 | 2,743.80 | 5.81% | 8.10% |

| IBULHSGFIN | 40,248,000 | 136.7 | 3.17% | 7.38% |

| ESCORTS | 1,065,900 | 2,142.45 | 0.20% | 6.71% |

| TATACOMM | 2,468,500 | 1,222 | 2.91% | 5.29% |

Long unwinding

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| DALBHARAT | 1,338,500 | 1,534.90 | -2.81% | -7.02% |

| GRANULES | 8,738,000 | 348.7 | -0.71% | -4.53% |

| ICICIBANK | 83,274,125 | 884.7 | -0.23% | -2.90% |

| IDFCFIRSTB | 192,030,000 | 53.1 | -2.48% | -2.84% |

| UBL | 1,050,800 | 1,722.75 | -0.70% | -2.63% |

(Increase in price and decrease in open interest)

Short covering

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| ASTRAL | 1,167,650 | 2,275 | 0.63% | -6.41% |

| BERGEPAINT | 7,517,400 | 630 | 2.06% | -6.03% |

| M&MFIN | 22,212,000 | 201.6 | 0.62% | -4.86% |

| AXISBANK | 46,227,600 | 756.9 | 0.13% | -4.85% |

| CUB | 7,545,000 | 179.95 | 4.71% | -4.44% |

(Increase in price and decrease in open interest)

Short build-up

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| HEROMOTOCO | 2,355,300 | 2,624 | -0.94% | 20.10% |

| AARTIIND | 3,029,400 | 769.3 | -1.21% | 15.49% |

| RAMCOCEM | 2,933,350 | 729.45 | -3.73% | 9.21% |

| BIOCON | 18,114,800 | 283.95 | -2.99% | 8.68% |

| M&M | 10,230,500 | 1,245.10 | -1.32% | 8.02% |

(Decrease in price and increase in open interest)

52-week highs

A total of 13 stocks in the BSE 500 universe — the broadest index on the bourse — reached the milestone.

| CHALET | MAHINDCIE | RENUKA |

| EIDPARRY | MAZDOCK | RITES |

| KALYANKJIL | MIDHANI | SOLARINDS |

| KRBL | PHOENIXLTD | |

| LEMONTREE | PRAJIND |

52-week lows

One stock hit a 52-week low: Motilal Oswal Financial Services.

First Published: Oct 9, 2022 5:51 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Supreme Court says it may consider interim bail for Arvind Kejriwal due to ongoing Lok Sabha polls

May 3, 2024 4:57 PM

10% discount on fare on Mumbai Metro lines 2 and 7A on May 20

May 3, 2024 2:40 PM