Indian equity benchmarks slipped into the red in a volatile session on Thursday, as the heavyweight financial and IT pockets gave up initial gains in the second half of the day. Gains in oil & gas stocks, however, limited the downside in headline indices.

A fresh four-decade high in US inflation worried investors globally, denting the sentiment on Dalal Street.

What do the charts suggest for Dalal Street now?

The Nifty50 has formed a small negative candle on the daily chart with upper and lower shadows, according to Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

There is no confirmation of a short-term bottom reversal in the market yet, he said.

More pain on the cards

The overall structure of the market suggests the 50-scrip index has the potential to break near-term support at 15,850-15,800 and head to even lower levels towards 15,500, said Gaurav Ratnaparkhi, Head of Technical Research at Sharekhan by BNP Paribas.

He views any bounce towards the near-term hurdle of 16,000-16,050 as a fresh selling opportunity.

Here are key things to know about the market ahead of the July 15 session:

SGX Nifty

Singapore Exchange (SGX) Nifty futures — an early indicator of the Nifty index — rose as much as 34 points or 0.2 percent to 15,967.5 ahead of the opening bell on Dalal Street on Friday.

Global markets

Equities in other Asian markets saw mixed moves, mirroring the overnight session on Wall Street following disappointing results from JPMorgan Chase and Morgan Stanley though dovish remarks from two Fed central bankers aided investor mood somewhat. MSCI's broadest index of Asia Pacific shares outside Japan was down 0.1 percent in early hours.

Japan's Nikkei 225 was up 0.5 percent, but Hong Kong's Hang Seng down 0.7 percent and China's Shanghai Composite flat. S&P 500 futures were up 0.4 percent.

On Thursday, the S&P 500 fell 0.3 percent and the Dow Jones 0.5 percent. The Nasdaq Composite finished flat.

What to expect on Dalal Street

HDFC Securities' Shetti is of the view the Nifty's short-term trend remains negative.

"The overall chart pattern and the placement of key lower support are signaling a bounce from close to 15,800 in the next 1-2 sessions," he said.

Important levels to track

The Nifty50 is about 6.8 percent below its long-term simple moving average (SMA).

| Period (No. of sessions) | SMA | |

| Nifty50 | Nifty Bank | |

| 5 | 16,118.9 | 35,094.8 |

| 10 | 15,976.3 | 34,452 |

| 20 | 15,777.8 | 33,804.4 |

| 50 | 16,049.1 | 34,239.2 |

| 100 | 16,569.7 | 35,215.4 |

| 200 | 17,099.2 | 36,495 |

Mohit Nigam, Head-PMS at Hem Securities, has identified the following levels to watch out for:

| Index | Support | Resistance |

| Nifty50 | 15,800 | 16,100 |

| Nifty Bank | 34,350 | 35,000 |

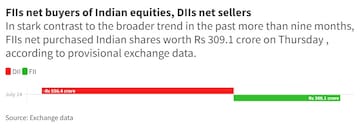

FII/DII activity

Call/put open interest

The maximum call open interest is accumulated at the strike price of 16,000, with 1.7 lakh contracts, and the next highest at 16,500, with 1.6 lakh contracts, according to exchange data. The maximum put open interest is at 15,900, with 1.7 lakh contracts, and 15,700, with 1.3 lakh.

This suggests a tough hurdle at 16,500 after immediate resistance at the 16,000 mark. On the other hand, support is placed at 15,900 and then 15,700.

Long build-up

Here are five stocks that saw an increase in open interest as well as price:

| Stock | Current OI | CMP | Price change | OI change |

| CROMPTON | 3,768,000 | 389.25 | 1.45% | 15.61% |

| ALKEM | 219,000 | 3,204.75 | 1.58% | 11.42% |

| DRREDDY | 1,888,625 | 4,582 | 1.54% | 10.42% |

| LAURUSLABS | 5,430,600 | 521 | 1.49% | 9.48% |

| PVR | 2,051,280 | 1,913.20 | 0.39% | 8.73% |

Long unwinding

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| DELTACORP | 16,288,600 | 177.7 | -1.58% | -2.49% |

| TATACOMM | 3,017,500 | 970.5 | -1.66% | -2.40% |

| NAM-INDIA | 3,052,800 | 281.3 | -2.04% | -2.04% |

| BALKRISIND | 1,413,300 | 2,293 | -0.18% | -2.00% |

| SBICARD | 5,474,400 | 845.7 | -1.41% | -1.34% |

(Decrease in open interest as well as price)

Short covering

| Stock | Current OI | CMP | Price change | OI change |

| MFSL | 1,357,200 | 833.2 | 0.38% | -4.21% |

| SRTRANSFIN | 4,006,800 | 1,285.10 | 1.84% | -1.54% |

| BRITANNIA | 1,775,800 | 3,775.70 | 0.97% | -1.31% |

| IPCALAB | 778,050 | 983.25 | 1.32% | -1.00% |

| MARICO | 11,548,800 | 509.7 | 1.07% | -0.98% |

(Increase in price and decrease in open interest)

Short build-up

| Stock | Current OI | CMP | Price change | OI change |

| COFORGE | 512,100 | 3,370 | -3.35% | 34.86% |

| BSOFT | 3,482,700 | 316.45 | -5.69% | 21.58% |

| SYNGENE | 1,005,000 | 590.4 | -0.51% | 11.24% |

| LTI | 1,568,700 | 3,892.05 | -3.52% | 11.17% |

| MINDTREE | 3,439,000 | 2,799 | -3.76% | 10.82% |

(Decrease in price and increase in open interest)

52-week highs

Only one stock on the BSE 500 — the broadest index on the bourse — touched the milestone: Varun Beverages.

52-week lows

Eight stocks in the 500-scrip basket hit 52-week lows: TCS, HCL Tech, Wipro, Birlasoft, Gland Pharma, Mphasis, NMDC and PB Fintech.

First Published: Jul 14, 2022 7:33 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM