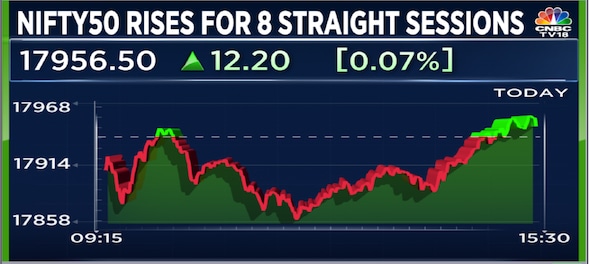

Indian equity benchmarks finished a choppy session in the green on Thursday, with the Nifty50 taking its winning spree to the eighth session in a row. Minutes of the Federal Open Market Committee's last policy review raised hopes the US central bank may not be as aggressive with hikes in COVID-era interest rates as thought earlier.

What do the charts suggest for Dalal Street?

The Nifty50 has formed a reasonable positive candle on the daily chart, reflecting sideways movement close to the highs, according to Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He believes the overall uptrend of the 50-scrip index remains intact.

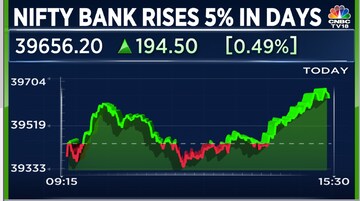

More upside on the cards for Nifty Bank

Momentum indicator RSI is in a bullish crossover for the Nifty Bank, said Rupak De, Senior Technical Analyst at LKP Securities.

"The trend for the short term is likely to remain strong," said De, who sees resistance for the banking index at 40,100 and support in the 39,250-39,000 zone.

Here are key things to know about the market ahead of the August 19 session:

SGX Nifty

On Friday, Singapore Exchange (SGX) Nifty futures — an early indicator of the Nifty index — were last seen trading lower by 36 points or 0.2 percent at 17,968 ahead of the opening bell on Dalal Street, in some recovery after falling as much as 52.5 points earlier in the day.

Global markets

Equities in other parts of Asia saw mixed moves despite a strong session on Wall Street overnight, as investors around the globe tried to read between the lines after minutes of the FOMC's last meeting released this week suggested a less aggressive pace of rate hikes. MSCI's broadest index of Asia Pacific shares outside Japan was down 0.1 percent at the last count.

Japan's Nikkei 225 was up 0.1 percent and Hong Kong's Hang Seng 0.3 percent, but China's Shanghai Composite flat and South Korea's KOSPI down 0.2 percent.

S&P 500 futures edged 0.1 percent lower. On Thursday, the S&P 500 rose and the tech stocks-heavy Nasdaq Composite rose 0.2 percent each, and the Dow Jones 0.1 percent.

What to expect on Dalal Street

HDFC Securities' Shetti believes a sustainable move above 17,900-18,000 levels in the short term can open the next upside target in the 18,500-18,600 zone in the coming week.

He sees crucial supports at 17,760.

Key moving averages

In a bullish sign, the Nifty50 continues to be almost six percent above its long-term simple moving average.

| Period (No. of sessions) | SMA | |

| Nifty50 | Nifty Bank | |

| 5 | 17,924.7 | 39,538.1 |

| 10 | 17,914.6 | 39,488.5 |

| 20 | 17,896 | 39,389.4 |

| 50 | 17,742.8 | 39,010.5 |

| 100 | 17,534.2 | 38,432.9 |

| 200 | 16,974.7 | 37,202.3 |

Palak Kothari, Senior Technical Analyst at Choice Broking, identified the following support and resistance levels:

| Index | Support | Resistance |

| Nifty50 | 17,800 | 18,100 |

| Nifty Bank | 39,000 | 40,000 |

FII/DII activity

Foreign institutional investors (FIIs) emerged net sellers of Indian shares after remaining net buyers for 13 days in a row.

Their net sales on Thursday stood at Rs 1,706 crore whereas domestic institutional investors (DIIs) made net purchases of Rs 471 crore, according to provisional exchange data.

Call/put open interest

The maximum call open interest is accumulated at the strike price of 18,000, with two lakh contracts, and the next highest at 18,100 and 18,300, with 1.2 lakh each, according to exchange data. On the other hand, the maximum put open interest is at 17,900, with 1.4 lakh contracts, and at 17,800 and 17,950, with 1.1 lakh each.

This suggests strong resistance at the 18,000 mark and a firm base at 17,900.

Long build-up

Here are five stocks that saw an increase in open interest as well as price:

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| DIXON | 605,125 | 4,076.65 | 1.29% | 8.35% |

| LT | 8,673,600 | 1,897.55 | 1.87% | 6.59% |

| DABUR | 10,248,750 | 596 | 1.59% | 6.38% |

| DALBHARAT | 1,282,500 | 1,677 | 5.05% | 6.35% |

| FSL | 14,591,200 | 111.25 | 0.09% | 5.42% |

Long unwinding

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| INTELLECT | 1,814,250 | 627.15 | -1.47% | -5.99% |

| MGL | 3,038,400 | 894.05 | -1.66% | -3.71% |

| ESCORTS | 1,897,500 | 1,806.70 | -0.85% | -3.39% |

| WHIRLPOOL | 707,000 | 1,824.30 | -0.01% | -3.07% |

| BRITANNIA | 1,791,200 | 3,699.85 | -0.36% | -2.98% |

(Increase in price and decrease in open interest)

Short covering

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| INDIACEM | 13,908,400 | 205.2 | 6.10% | -9.86% |

| TATACONSUM | 8,983,800 | 810 | 1.98% | -5.26% |

| KOTAKBANK | 16,785,200 | 1,913.50 | 3.68% | -3.18% |

| TATACHEM | 7,477,000 | 1,124.30 | 1.15% | -3.02% |

| POLYCAB | 848,400 | 2,461.35 | 0.33% | -2.76% |

(Increase in price and decrease in open interest)

Short build-up

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| DRREDDY | 1,742,000 | 4,214.15 | -2.47% | 13.17% |

| IEX | 50,865,000 | 167.15 | -3.33% | 7.87% |

| HINDPETRO | 18,881,100 | 263.65 | -0.43% | 7.34% |

| ONGC | 52,621,800 | 136.25 | -0.44% | 7.23% |

| MUTHOOTFIN | 5,437,875 | 1,062.95 | -0.54% | 5.77% |

(Decrease in price and increase in open interest)

First Published: Aug 18, 2022 7:12 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM