Indian equity benchmarks snapped a rally that lasted six back-to-back sessions in a choppy session on Friday, a day ahead of the outcome of a three-day meeting of the RBI's interest rate-setting panel.

The central bank is widely expected to announce a further hike in the COVID-era repo rate — or the key rate at which it lends money to commercial banks — on Friday, having already hiked it by a total 90 bps since May.

What do the charts suggest for Dalal Street?

The Nifty50 has formed a small negative candle on the daily chart with a long lower shadow, suggesting the making of a bearish hanging man pattern, according to Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

However, the predictive value of this pattern is less because it has come about amid rangebound movement, he pointed out. "The positive sequence of higher tops and bottoms is intact on the daily chart and any weakness could be a 'buy on dips' opportunity at the higher bottom," he added.

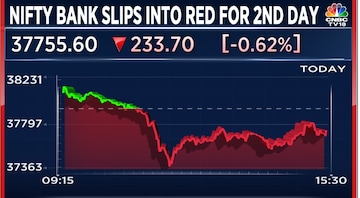

Downside cannot be ruled out in Nifty Bank

High volatility in the Nifty Bank a day ahead of the RBI policy suggests the bulls and the bears are trying to fight from both ends with support at 37,200 and resistance at 38,200, said Kunal Shah, Senior Technical Analyst at LKP Securities.

"The index needs to break on either side on a closing basis for a trending move... It is already in an overbought zone and a correction cannot be ruled out," he said.

Here are key things to know about the market ahead of the August 5 session:

SGX Nifty

On Friday, Singapore Exchange (SGX) Nifty futures — an early indicator of the Nifty index — rose as much as 58 points or 0.3 percent to 17,455 ahead of the opening bell.

Global markets

Equities in other Asian markets began Friday in the green following a mixed session on Wall Street overnight. MSCI's broadest index of Asia Pacific shares outside Japan was up 0.6 percent at the last count.

Japan's Nikkei 225 was up 0.7 percent and China's Shanghai Composite 0.2 percent, though Hong Kong's Hang Seng slipped 0.1 percent.

S&P 500 futures were up 0.3 percent. On Thursday, gains in high-growth stocks offset losses in energy shares. The S&P 500 slid 0.1 percent and the Dow Jones 0.3 percent. The tech stocks-heavy Nasdaq Composite climbed up 0.4 percent.

What to expect on Dalal Street

HDFC Securities' Shetti continues to believe that the 50-scrip index's short-term uptrend is intact. "There is no indication of any sharp reversal at the highs," he said.

He expects consolidation with high volatility to continue for the next 1-2 sessions, with immediate support at 17,200 and strong resistance at 17,500.

"A decisive move above the hurdle (17,500) could push the Nifty towards the next upside trajectory of 17,800," he added.

Important levels to track

In a bullish signal, the Nifty50 stands almost six percent above its long-term simple moving average.

| Period (No. of sessions) | SMA | |

| Nifty50 | Nifty Bank | |

| 5 | 17,330.3 | 37,666.2 |

| 10 | 17,354.1 | 37,813.2 |

| 20 | 17,321.2 | 37,851.1 |

| 50 | 17,154.5 | 37,646.4 |

| 100 | 16,852 | 37,000.9 |

| 200 | 16,430.3 | 35,819.4 |

FII/DII activity

Call/put open interest

The maximum call open interest is accumulated at the strike price of 17,500, with 1.7 lakh contracts, and the next highest at 17,600 and 17,800, with 1.5 lakh each, according to exchange data.

On the other hand, the maximum put open interest at 17,000, with 1.4 lakh contracts, and then 17,300 and 17,350, with 1.2 lakh each.

This suggests a major hurdle at 17,500 and immediate support in the 17,350-17,300 band.

Long build-up

Here are five stocks that saw an increase in open interest as well as price:

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| ALKEM | 339,000 | 3,114 | 0.91% | 41.71% |

| LUPIN | 9,200,400 | 661.5 | 5.14% | 20.30% |

| APOLLOTYRE | 11,004,000 | 232.85 | 1.66% | 16.38% |

| NMDC | 82,430,100 | 107.2 | 0.89% | 15.63% |

| INDIAMART | 259,050 | 4,509 | 4.67% | 14.42% |

Long unwinding

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| INDIACEM | 10,071,700 | 189.2 | -1.23% | -4.55% |

| JUBLFOOD | 11,340,000 | 569.5 | -1.05% | -4.31% |

| WHIRLPOOL | 562,100 | 1,789.40 | -0.34% | -4.05% |

| GRANULES | 14,530,000 | 311.1 | -1.54% | -3.74% |

| OBEROIRLTY | 5,094,600 | 896.25 | -1.75% | -3.53% |

(Increase in price and decrease in open interest)

Short covering

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| AUBANK | 7,183,000 | 638.35 | 4.81% | -9.44% |

| BOSCHLTD | 195,300 | 17,612.05 | 1.34% | -6.68% |

| HONAUT | 15,450 | 41,037.10 | 1.94% | -5.53% |

| NAVINFLUOR | 578,475 | 4,333.85 | 1.26% | -5.52% |

| DRREDDY | 2,640,875 | 4,168.40 | 1.53% | -4.87% |

(Increase in price and decrease in open interest)

Short build-up

| Stock | Current OI | CMP | Price change (%) | OI change (%) |

| GUJGASLTD | 3,202,500 | 434.65 | -6.03% | 79.55% |

| TATACONSUM | 7,466,400 | 791.45 | -3.10% | 17.83% |

| NAM-INDIA | 2,454,400 | 298.35 | -0.55% | 15.25% |

| CROMPTON | 2,656,500 | 380 | -3.17% | 14.06% |

| INDUSTOWER | 16,909,200 | 202.7 | -1.77% | 12.25% |

(Decrease in price and increase in open interest)

52-week highs

A total of 18 stocks on the BSE 500 — the broadest index on the bourse —touched the milestone:

| ADANIENT | EICHERMOT | KEI |

| ADANIPOWER | ELGIEQUIP | M&M |

| ADANITRANS | GESHIP | METROBRAND |

| ATGL | INDHOTEL | MRF |

| BLUEDART | INOXLEISUR | PVR |

| DEEPAKFERT | JKPAPER | VBL |

52-week lows

Two stocks in the 500-scrip pack hit 52-week lows: GlaxoSmithKline Pharma and Zensar Tech.

First Published: Aug 4, 2022 7:18 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election Phase 2: Experts decode the key trends and issues in key battleground states

Apr 26, 2024 11:53 PM

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM