In the latest episode of 'Smart Money,' Gurmeet Chadha, a financial expert from Complete Circle Consultants, shares his insights on the key investment themes for the year 2024. Chadha highlights four major sectors that are poised for growth and potential returns: power, digital push, auto, and tourism.

Chadha emphasises the robust performance of the power sector, noting that power demand has exceeded GDP growth. With a growth rate surpassing 8%, he sees significant potential, especially at the transmission level. Companies like Power Grid, NTPC, and Tata Power are spotlighted for their promising prospects. Chadha, however, cautions investors to be mindful of valuations due to the recent market run-up.

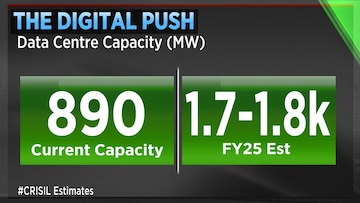

The second major theme outlined by Chadha revolves around the expansion of data centers and digital engineering. He predicts a substantial increase in data center capacity, presenting opportunities for companies like L&T.

Furthermore, Chadha highlights the evolution of digital engineering in India, citing Tata Tech as an example, albeit with stretched post-IPO valuations. He suggests a longer-term view, appreciating the capabilities these companies are developing.

Discussing the automotive sector, Chadha expressed his positive stance describing it as a strategic investment space aligned with the current trend of premiumisation. He pointed out a notable shift in the sedan-to-utility vehicle ratio, now standing at almost two-thirds sedans and one-third utility vehicles.

According to Chadha, major players like

Mahindra & Mahindra (M&M) and Tata Motors are poised to reap substantial benefits. He particularly emphasised Tata Motors, highlighting the revival of Jaguar Land Rover (JLR) and the company's strides in the electric vehicle (EV) domain.

Chadha delved into the tourism sector, identifying it as a realm of multiple investment opportunities with both short-term tactical plays and more long-term structural prospects. He spotlighted the

hotel business, traditionally known for its cyclical nature.

However, Chadha pointed out a noteworthy shift in dynamics, citing a demand of 10-12% versus a supply of 6-7% last year. This demand-supply gap, especially pronounced in metropolitan areas, is anticipated to persist for the next two to three years.