The risk-reward is currently more favourable for long-term investors and the recent correction in the market has provided an opportunity for long-term investors to enter the market at a better valuation. The Indian equities continue to trade at a premium, and the Nifty earnings per share (EPS) growth is expected to improve further in the coming years.

In an interview with CNBC-TV18, Gautam Duggad, Head Research-Institutional Equities at Motilal Oswal Financial Services said that the risk-reward is currently more favourable for long-term investors.

He said, “When you look at the equation of price and value, it looks that risk-reward is slightly more favourable now. Having said that, on a relative basis, we are still slightly more expensive than the long period average, which I think we deserve given the growth that we have seen in the last three years.”

According to him, despite the recent volatility in the market, Indian equities continue to trade at a premium. This premium is justified, as the Indian economy is expected to grow at a healthy rate in the coming years. The Nifty EPS saw a growth of 13-14 percent in FY23, which is a positive sign for the market.

Although the rate hikes have been steep, the Nifty EPS growth in FY23 was not bad. The growth is a result of the strong fundamentals of the Indian economy. The Indian market is expected to continue to grow, and the Nifty EPS is likely to improve further in the coming years.

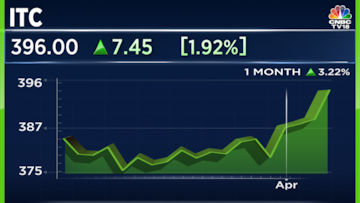

Talking about specific stocks, Duggad said that adding ITC, Indian Hotels and Vedant Fashions to the portfolio is a smart move, and the IT sector is expected to continue to perform well in the coming years. Consumption stocks have seen a massive time correction in recent months and this correction has provided an opportunity for investors to enter the market at a better valuation.

“We have increased the weight of consumer stocks and added a few more stocks. We have already had a large weight on ITC. We have allocated 100 basis points more there. We have added Indian Hotels, we have added Vedant Fashions and aside from that we already had Titan, Godrej Consumer and Metro Brands. So now we are having about 200-300 basis points of him overweight stance there,” he said.

He further said that IT companies have performed well in recent years. However, he does not expect big downgrades in growth guidance from them. The IT sector is a significant contributor to the Indian economy, and the companies in this sector are expected to continue to perform well in the coming years.

Overall, the Indian equity market is expected to perform well in the long term, and investors should consider investing in this market.

For more details, watch the accompanying video