The primary market is currently witnessing remarkable activity as June witnessed an unprecedented surge in initial public offerings (IPOs), with several notable listings such as

ideaForge Technology and Cyient DLM.

These IPOs proved to be exceptionally successful, with

Cyient DLM listing at a significant premium of more than 50 percent compared to its issue price. The remarkable performance of these listings highlights the excitement and positive reception in the primary market during this period.

In an interview with CNBC-TV18, Raja Lahiri, Partner at Grant Thornton Bharat, and Pranav Haldea, managing director of Prime Database discussed at length about the current state of IPO activity worldwide, highlighting potential challenges and trends impacting the global market.

First up, talking about the global IPO landscape, Lahiri said it has experienced a decline with IPO volumes decreasing by 5 percent.

"The global volumes are down by 5 percent. The values are down by 36 percent. So, there is clearly a slowdown in the market. So, India can't be kind of different from that.

But what is standing out is the Asia Pacific constitutes 60 percent of the global IPOs and from a growth momentum perspective, I do believe that this decade will be driven by IPOs from Asia Pacific and largely India," Lahiri said.

While global IPO volumes have experienced a decline, the Indian market shows promise with a substantial number of companies ready to tap into the capital market for fundraising purposes.

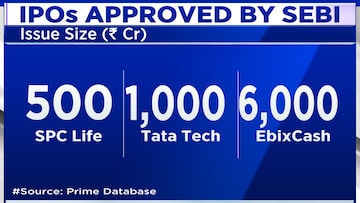

Therefore, talking about the Indian IPO market, Haldea stated that there are 42 companies in India that have obtained approval from the Securities and Exchange Board of India (SEBI) to raise a staggering Rs 50,000 crore.

"There are about 42 companies looking to raise Rs 50,000 crore which are holding SEBI approval and other 26 companies looking to raise Rs 36,000 crore which are awaiting SEBI approval. So, as far as the supply side is concerned there is no dearth of course, the market sentiment needs to be opportune," Haldea said.

This indicates a strong pipeline of upcoming IPOs in the Indian market, showcasing the continued interest and confidence of businesses in accessing the capital markets for growth and expansion.

For more details, watch an accompanying video