The Sensex jumped nearly 900 points and the Nifty rallied over 272 points on Friday, bouncing back from the previous day's fall, following a positive trend in global equities and fresh foreign fund inflows. It's a good day for markets with strong gains on the benchmark Nifty.

US markets gave us a good handover both the S&P-500 and the NASDAQ ending higher even though yields and the dollar remained strong. The Nifty has made a high of 17,579 – just under the first resistance level of 17,591 (38 percent retracement of the recent fall).

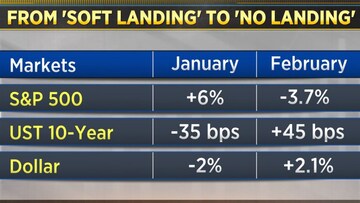

A recap of how the mood in the market has changed. In January, the sentiment was that the markets will land very softly and it will be a gentle landing. The S&P went up 6 percent, the 10-year went down 35 basis points and the dollar was down 2 percent.

In one month flat as the very hot data out of the US, which is jobs data, services PMI, jobless claims, and many others all in the last one month, it became from soft landing to no landing, which means the economy will continue to do well and the Fed will have to fight longer fight.

And this is what happened, as a result, it completely flipped. As March has started, the markets are now pretty much continuing where they left off in February and the data is still strong right?

The main worry for global markets is the US 2-year yield, which has broken out some significant levels and it is surging. Across tenors basically, 5-year, 10-year an30-year across-the-board yields are surging, and this is not good news. The worry is if there is a regime of higher for longer, which is rates go up and they stay up for longer it leads to, in a way negative externalities.

There is demand destruction which is negative for companies, margins are hurt, there is higher interest cost for levered assets, especially things like real estate, etc. and there are asset write-downs and credit losses as well. This is the cost of ‘higher for longer’ and this is what the market fears.

But there is hope!

The rates market in the US is also looking extremely overbought. Across tenors, 2-year, 5-year, 10-year and 30-year things are looking very, very overbought, or oversold, which means that it could limit the significant further upside, at least in the near term.

The other thing is, the breakout in the 2-Year yield has not yet been confirmed by the 10-year and 30-year. It is not as if the entire yield curve is pushing higher with the same ferocity. The Feds terminal rate pricing remains a moving target and is of course dictated by data. Also, one or two weak economic data prints will show that things are cooling up a little bit, the economy is cooling up a little bit and it will be back to sort of the soft landing environment, which was prevalent in January.

FII net short positioning in the market

As of yesterday, the net short position of FIIs was about not 1.31 lakh contracts. Looking at the previous instances, October 2022 to 1.37 lakh, June 2022 to 1.46 lakh, and May 2022 to 1.24 lakh, all of it about more than 1.2 lakh net short contracts.

The change 30 days later markets in all three instances rallied to varying degrees. The question is, what next, could this become bigger is the question. The mood is negative, Street refuse to believe that we will see a meaningful rally, not big but a meaningful rally in the face of all the global worries, but markets are known to surprise