With the mega rally in several textile stocks in the past few years, a large section of market experts believes cherry-picking would be critical.

“We see headwinds and tailwinds in the textile industry,” Sunil Damania, Chief Investment Officer of MarketsMojo, told CNBC-TV18.com.

Damania believes investors need to be stock-specific regarding the textile sector.

Lately, the textile sector has been marred by challenges like all-time high cotton prices, increasing freight expenses, order delivery delays, and inventory pile-up for large global retailers.

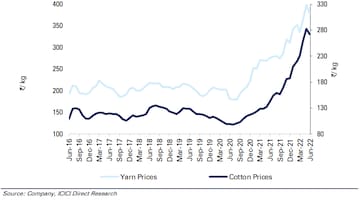

Significant rise in cotton prices | The main reason for the massive spike in cotton prices has been lower production estimates by industry bodies like Cotton Corporation of India and an increase in consumption demand, said ICICI Securities.

Significant rise in cotton prices | The main reason for the massive spike in cotton prices has been lower production estimates by industry bodies like Cotton Corporation of India and an increase in consumption demand, said ICICI Securities.Also Read |

Additionally, the inability of US retailers to absorb higher prices due to the recent surge in inflation was another concern.

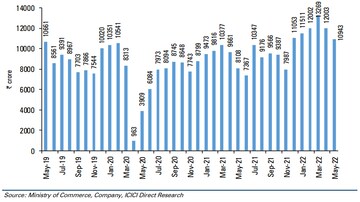

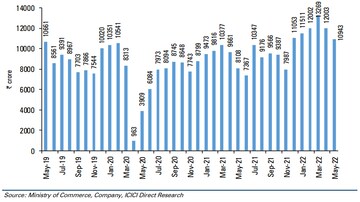

Indian home textile players witnessed a decline in market share in the US. This comes at a time when India’s apparel export data in May 2022 saw a receding trajectory.

“US is one of the key textile markets for India accounting for 50 percent of home textile exports and 28 percent of apparel exports. Hence, reduced purchasing power in key export markets would negatively impact the order books of Indian exporters,” said ICICI Securities.

India exports for cotton yarn & home-textile decline sharply in May 2022

India exports for apparel slowing down in April-May 2022

Despite the textile stocks witnessing a significant run-up in the past two years, the domestic brokerage firm believes that the current headwinds could, in the near term, outweigh the long-term structural story of expected free trade agreements with Europe or the UK, Production Linked Incentive scheme and China+1 strategy.

| Textile companies | Rise in past 3 years |

| KPR Mill | 308% |

| Alok Industries | 510% |

| Nitin Spinners | 188% |

| GokalDas Exports | 270% |

| Filatex India | 154% |

| Indo Count Industries | 312% |

Damania highlighted that it is also crucial to know if the company one is buying has debt. With interest rates increasing, those on borrowed books will have a double whammy of rising interest costs and lower margins impacting their bottom line, he explained.

“Textile has never created sustainable wealth for investors in the long run. They are typically patchy performers, where they would do reasonably well for a while and then begin to underperform. Hence, it is vital to stay nimble-footed when investing in textile stocks,” he said.

A similar view was echoed by Suman Bannerjee, Chief Investment Officer of hedge fund Hedonova which specialises in investing in alternative assets, including start-ups, NFTs, art, wine and emerging market real estate among other things.

He said that the current macroeconomics for Indian textile is very unfavourable.

“India has been losing exports to China, Myanmar, Vietnam and Bangladesh for decades now. Though the freight cost has come down this year by 50 percent, weak rupee and extreme competition from Bangladesh will reduce exports significantly,” Bannerjee told CNBC-TV18.com.

To put things into perspective, a 1x1 meter cotton cloth costs 240 rupees to manufacture in India while the same costs 58 rupees in Bangladesh, he explained.

He suggests staying away from textile stocks simply because textile is one of the first sectors to take a hit when inflation is high.

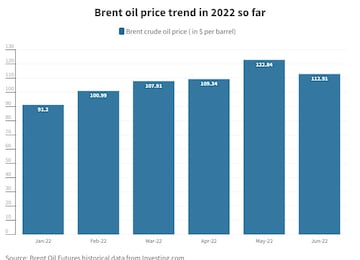

“On the cost side, the textile industry is basically 30 percent cotton and 70 percent chemicals and the base for almost every chemical is crude or a derivative of crude. With crude being so high right now, raw material costs will rise significantly and put pressure on margins,” he elaborated.

Earlier this week, Jyotivardhan Jaipuria, Founder and Managing Director of Valentis Advisors, told CNBC-TV18 that the textile sector would be a little more challenging considering cotton prices have shot up.

"So, all the companies are facing volume and margin pressure. Additionally, he believes that all the global economies are going to slow and as they slow the demand environment will turn more adverse than it was over the last 18 months. That will also start putting some pressure on these textile companies," he added.

“We expect companies with better balance sheets to weather the challenging scenario. The textile sector has good long-term potential but we advise a cautious stance on the sector currently owing to near-term headwinds. Hence, we downgrade the stocks from BUY to HOLD,” said ICICI Securities.

The domestic brokerage firm has KPR Mill, Gokaldas Exports, Indo Count, Faze Three and Vardhman Textiles in its coverage.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM