IT stocks remained under pressure on Tuesday, a day after Tata Consultancy Services (TCS) kicked off the earnings season by reporting a strong performance in the July-September period. Investors on Dalal Street remained on the back foot amid negative global cues, as concerns persisted about the impact of steep rate hikes on economic growth and geopolitical tensions.

TCS, Infosys, Wipro, HCL Technologies and Wipro fell 1-3 percent in late afternoon deals. The Nifty IT — whose 10 members include the country's five largest software exporters — dropped as much as 1.8 percent during the session.

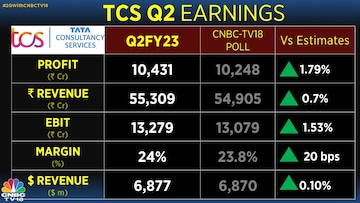

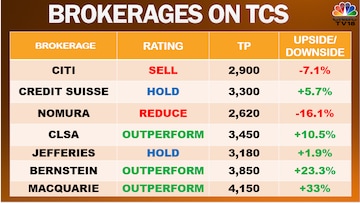

Analysts have mixed views on TCS even as the country's largest software exporter staged a strong all-round performance with a quarterly net profit of more than Rs 10,000 crore for the first time ever. Many of them fear that rapid rate hikes may send the world economy into a recession.

Infosys, Wipro and HCL Tech are due to report their financial results this week.

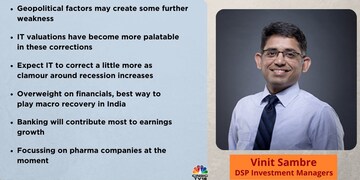

IT stocks — which have the second maximum weight in the Nifty50 pack after financial services — have been among the major laggards on Dalal Street for much of 2022 amid fears that high employee costs will continue to eat into the margin of the sector despite robust demand.

Dipan Mehta, Director at Elixir Equities, has a 'wait and watch' stance on the sector. "The global environment is just getting murkier and murkier. And where all this going to end is very difficult to see. And it's not that the stocks are really at very attractive valuations. You may have a bounce today, but I'm not convinced that next 3-4 quarters are going to be exceptionally good for TCS," Mehta told CNBC-TV18.

Mehta prefers spaces such as banking, auto and consumption-oriented businesses to IT.

“If you look at the playbook of previous slowdowns or recessions, typically what we have had in IT is a couple of quarters with not a whole lot of growth or maybe no growth, but once that is factored in, you will probably see that the risk to revenue growth estimates is probably around 2-4 percent," Abhiram Eleswarapu, Head of India Equity BNP Paribas India, told CNBC-TV18.

Largecap companies are able to deal with such a situation with better control over their costs as well as attrition, he said. "I am not sure there will be a change this time as the playbook of the last several slowdowns is that largecap companies have come out better during a recessionary environment,” he said.

On Infosys, which will post its quarterly numbers on Thursday, Mehta said: "It's always better from a long-term investor’s perspective to wait and see what the management has to say, and then perhaps make a more informed decision."

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 20% voter turnout recorded by 11 am

Apr 26, 2024 9:11 AM