Tata Steel Ltd on Tuesday, March 19, said that its board has approved the raising of funds worth ₹2,700 crore through- unsecured Non-Convertible Debentures (NCDs) on a private placement basis, the company informed the bourses.

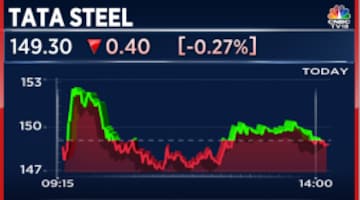

Shares of Tata Steel were trading 0.033% higher at ₹149.75 on NSE in today's session. Tata Steel stock opened at ₹149 and hit a day's high of ₹152.45 on Tuesday.

Tata Steel shares have gained 7% so far in 2024 and risen 43% in a year.

The date of allotment of the NCDs is March 27, 2024, and they will mature after three years of the allotment date.

Tata Steel in a regulatory filing said the issuance will be done on a private placement basis to eligible investors. The company will issue a total of 2,70,000 NCDs of face value ₹1,00,000 each aggregating to ₹2,700 crore, the filing said.

NCDs are long-term financial instruments that companies issue to raise more money from investors. They are not backed by any collateral and thus highly depends on the creditworthiness and reputation of the issuer.

Besides, the company's UK arm has decided to cease operations of the coke ovens at the Port Talbot plant, in Wales, following a deterioration of operational stability.

Tata Steel UK will increase imports of coke to offset the impact of the coke oven closures, the company said in an exchange filing. Tata Steel had previously stated that many of its heavy-end assets in Port Talbot are at their end-of-life capability.

First Published: Mar 19, 2024 2:45 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM