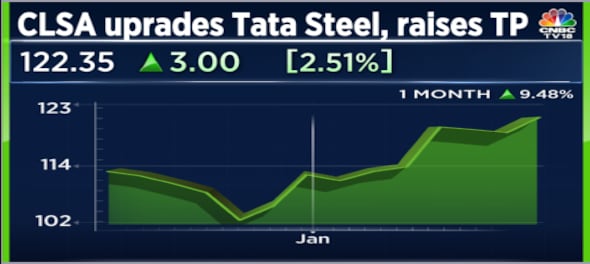

Tata Steel stock gained over 2 percent on Wednesday after global brokerage firm CLSA upgraded its rating on the steelmaker from 'sell' to 'outperform' with a target price of Rs 135 per share. CLSA believes Tata Steel is the biggest beneficiary of a demand-driven upcycle in China. It also said that the visibility on Kalinganagar expansion and Europe profitability is key.

Earlier on Tuesday, TV Narendran, CEO and managing director of Tata Steel, told Moneycontrol that the third quarter was the toughest for the European steel market, but is now witnessing signs of improvement.

CLSA pointed out that while domestic demand is resilient, large steel capacity additions could keep dependence on exports high. It expects steel prices to rise in the near term (in line with or at a discount to import parity) before softening in the following quarters.

Narendran noted that steel prices are going up in Southeast Asia to at least $70 to $80 while domestic prices in China are up $100. “In Europe, price increases have been sought. But in Europe, the fundamentals are still a bit weak,” he said.

He added that steel prices have been going up in India for the last couple of weeks, which is partly driven by demand as the January to June period is typically the peak season for steel consumption.

Also Read: Emotional connect between employees and organization very high at Tata Steel, says TV Narendran

Steel companies have pretty much reached the bottom as far as prices are concerned. "Over the last month, steel prices both in flat and long products have gone up around Rs 3,000-5,000, but it's still at levels which are much lower than what we saw one year back," said Narendran.

Meanwhile, CLSA, in its note, said China reopening was faster than expected after Beijing changed zero-COVID policy to zero-control. This fuelled expectations of a faster demand recovery for metals, although on ground demand still remains lack-lustre, it said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM