Coming after market hours, Tata Motors surprised the street on Monday with its proposal to demerge the company into two separate listed entities. If you are a Tata Motors shareholder, here are the key things you need to know:

What has Tata Motors said?

The commercial vehicles business and its related investments would be housed in one entity, while the passenger vehicles businesses, including PV (passenger vehicles), EV (electric vehicles), and JLR ( Jaguar Land Rover), and their related investments would be part of another entity,

Tata Motors said in a regulatory filing.

How will it be done?

The demerger, set to be implemented through a National Company Law Tribunal (NCLT) scheme of arrangement, ensures that all existing shareholders of TML will maintain identical shareholding in both listed entities.

What's in it for Tata Motors shareholders?

Tata Motors shareholders shall continue to have identical shareholdings in both of the listed entities.

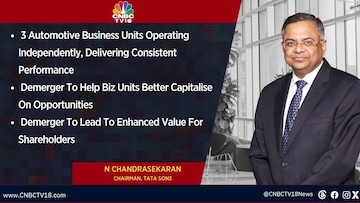

What has the management said about Tata Motors' demerger plan?

Chairman N Chandrasekaran said, "Tata Motors has scripted a strong turnaround in the last few years. The three automotive business units are now operating independently and delivering consistent performance. This demerger will help them better capitalise on the opportunities provided by the market by enhancing their focus and agility. This will lead to a superior experience for our customers, better growth prospects for our employees and, enhanced value for our shareholders.

Tata Motors share price performance

Shares of Tata Motors on Monday closed at ₹987.20 apiece on the BSE, a fall of Rs 1.20 or 0.12% over the previous close. Tata Motors was the best performer on the Nifty in 2023. Only stock to have doubled.

Out of the 34 analysts that track Tata Motors, 26 have a "buy" recommendation, five say "hold", while three have a "sell" rating. The stock is trading above its 12-month consensus price target of ₹951.22.

How have market experts reacted to the demerger plan?

Market expert Prakash Diwan told CNBC-TV18: "This is absolutely a very smart thing and very timely. Both of these businesses need a very different mindset; this kind of separation gets them to make a two plus two is five kind of growth, the agility that it gives. The PV segment is going to be great on a standalone basis. This is a precursor to the balance sheet becoming net debt-free, which they promised by March. Both of them will get different PE multiples; you can choose what you want to put your money into. I think the PV segment business will get a far higher multiple, and there will be a lot of value creation from that perspective."

First Published: Mar 4, 2024 5:18 PM IST