Taher Badshah, Chief Investment Officer (CIO) of Invesco Mutual Fund sees rewards outweighing risks in the Indian market in the first half of the calendar year 2024 given the strong economy.

He strongly believes much of the returns will be made in the first half of 2024, after which the market may take a breather.

"...there are certain risks which are lurking in the market, but probabilistically they are less likely to happen. So, we expect some of the current momentum to continue in the first," he said.

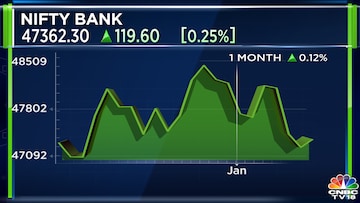

Among sectors, Badshah finds the banking, financial services, and insurance (BFSI) space attractive. The sector now encompasses a broader canvas, including both lenders and growth-oriented non-lenders, he notes.

However, Invesco is currently wary of pure gold financiers given the increased competition in the space.

Also Read

Badshah has a wait and watch approach on information technology (IT) and is awaiting management commentaries after the third quarter earnings.

According to a recent

CNBC-TV18 poll, four out of the six major IT companies, excluding HCL Tech and LTIMindtree, are expected to post a quarter-on-quarter (QoQ) decline in dollar revenue.

For Infosys, the expectation is of a

constant currency revenue decline of 1.6%. Estimates for this have a broad range from a decline of 2.3% from UBS and a decline of 0.9% projected by Nirmal Bang.

For the entire interview, watch the accompanying video