Analysts remained hopeful of Sun Pharma's growth prospects, advising clients to 'Buy' the stock and raising price targets after the pharma major's second-quarter results were in line with Street estimates on the overall front. The company posted a topline of ₹12,190 crore, which was led by India and Emerging Markets.

Following the quarterly results, shares of Sun Pharma rose 1% to ₹1,127.85 in Thursday's trading. The stock has rallied 15% in the last six months, compared to a 5.59% gain in the Nifty50 index.

"Notwithstanding the adverse impact of the Mohali consent decree, sequentially lower gRevlimid sales and higher R&D spends, Sun Pharma posted a fine Q2FY24. Barring Taro, sales across all segments were either higher or in line with our estimates," said Kotak Institutional Equities in a note to its clients.

Despite baking in a further increase in R&D spending, the domestic brokerage expects the pharma company to report a healthy 190 basis points EBITDA margin expansion over FY23 to FY26, led by higher profitability in speciality and better domestic productivity.

"We believe Sun Pharma's existing speciality portfolio is close to breakeven and as sales scale up further, the margin outlook is sanguine. We factor in 14% and 11% CAGRs (compound annual growth rates) in the global speciality and overall sales, respectively, over FY23-26E," Kotak said.

The management revealed that the dispatches from Mohali have resumed post-implementation of the corrective measures, which should aid growth in US sales going ahead.

"Specialty seems to be progressing well, shall see Winlevi (acne drug) and Sezaby (seizure drug) boost from FY25 and potential approval of deuruxolitinib (to treat alopecia areata) by FY26, Halol products have started to regain share and Mohali shall gradually inch toward normalcy," Nuvama said.

Motilal Oswal also remains bullish on Sun Pharma's growth prospects. It believes Sun Pharma is well-positioned to reinforce its speciality franchise through the addition of new products, the expansion of its reach, and the superior implementation of its existing products. "It continues to outperform both in the branded generics market of India (DF) and other emerging markets."

According to Choice Broking, the growth of the company will be driven by the continuous increase in the share of the speciality portfolio, and also the expansion of the speciality portfolio into new markets, increasing R&D spend will help to develop a strong speciality and generic R&D pipeline, and outperforming the industry growth in India.

The domestic brokerage expects the EBITDA margin for FY24-26 to be 26-27% due to continuous pick-up in the volume and increasing the share of speciality business in the upcoming quarters.

Stock target prices

Analysts at most brokerages have raised their target prices for the stock after Sun Pharma's healthy second-quarter performance.

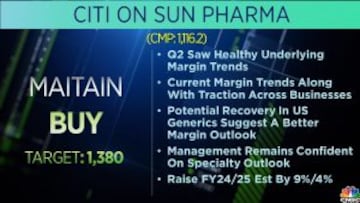

Global brokerage Citi has a 'Buy' rating on the counter and raised the target price to ₹1,380 per share. CLSA has also raised its target on the Sun Pharma stock to ₹1,340 along with a 'Buy' rating. Among domestic brokerages, Motilal Oswal has reiterated a 'Buy' rating with a target of ₹1,310, while Kotak and Choice Broking assigned 'Add' ratings with targets of ₹1,280 and ₹1,272, respectively.

Citi believes a potential recovery in the US generics segment suggests a better margin outlook for Sun Pharma. Accordingly, the brokerage has raised its FY24 and FY25 earnings estimates by 9% and 4%, respectively.

Jefferies said that the drug major's global speciality sales grew 19% YoY and 3% QoQ, and India sales outperformed the market after a soft first quarter. The US generic sales declined sharply sequentially due to lower sales of Grevlimid.

The global brokerage firm also sees a ramp-up in Sun Pharma's speciality sales and strong presence in the India/Emerging Markets as key drivers for the drugmaker's core earnings growth.

Macquarie is also hopeful about Sun Pharma's speciality portfolio as it sees major products including Ilumya, Winlevi, and Cequa witnessing encouraging prescription growth trends. As per the brokerage, the management sounded positive about its innovation medicines business.

(Edited by : Amrita)

First Published: Nov 2, 2023 10:19 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna's father in custody for alleged kidnapping and sexual abuse

May 4, 2024 7:53 PM

Delhi, Indore, Surat and Banswara — why these are the most challenging domains for Congress internally

May 4, 2024 1:53 PM

Congress nominee from Puri Lok Sabha seat withdraws, citing no funds from party

May 4, 2024 12:00 PM

Lok Sabha Polls '24 | Rahul Gandhi in Rae Bareli, why not Amethi

May 4, 2024 9:43 AM