Sixty of the S&P BSE 500 companies can distribute around Rs 88,600 crore surplus cash to their shareholders via dividends and buyback, said a report by proxy advisory firm Institutional Investor Advisory Services India Ltd (IiAS).

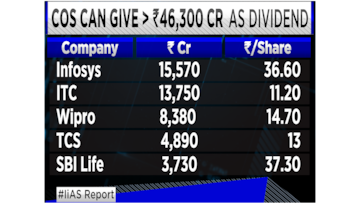

According to the ‘Dividend and Buy-back Study 2020’ based on FY19 financials, of these 60 companies, just five companies – Infosys, ITC, Wipro, Tata Consultancy Services and SBI Life Insurance - can give over Rs 46,300 crore as dividends.

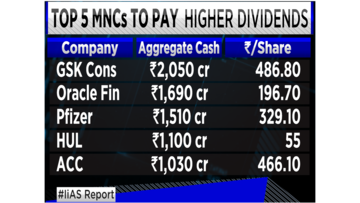

Almost one-third of the 60 companies are Multinational Corporations (MNCs).

In an interview to CNBCTV18, Hetal Dalal, COO of IiAS said that the number of companies they have identified have declined from 75 with excess cash of Rs 1,10,000 crore last year.

“One of the reasons for this is a lot of the companies have done buybacks. Last year there were about 25 companies which did buybacks. One third of those were part of our report last year. Companies have paid out excess dividend and also profitability has slowed down. PSUs have invested in capital expenditure,” Dalal said.

Further, the study reveals that the consolidated PAT for these 60 companies increased by 13.4 percent over FY18, while the profit after tax for the BSE 500 companies in aggregate increased by 0.3 percent.

“While the 60 companies have outperformed the index (based on profitability), almost half of these companies reported a decline in the FY19 return on equity (ROE), compared to the previous year: this should compel their boards to review capital allocation and return some of the excess cash to shareholders,” the report said.

The report said that the abolition of the Dividend Distribution Tax (DDT) augurs well for MNCs, as the foreign parent entity can claim credit for the corporate taxes paid in India on dividends in their home jurisdictions. On the other hand, family-owned companies may accelerate dividends before the next fiscal, to escape paying dividend taxes in personal capacities.

Speaking about dividends & buybacks, Dalal said, “We expect companies to have a much more structured philosophy around dividend payouts and cash hoarding.

The study expects the following companies to pay a higher dividend from here.

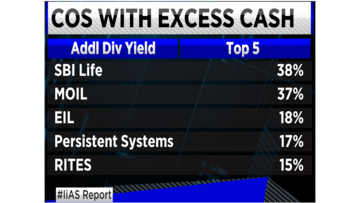

Moreover, the excess cash, if distributed by these 60 companies, translates to a median dividend yield to 3.8 percent, significantly higher than the current 1.1 percent. There are six companies where the excess cash translates into an additional dividend yield of more than 15 percent, according to the report.

The 60 companies can return a median of 52 percent of their total cash to shareholders. There are ten companies, the report added, that can distribute over 75 percent of their March 31, 2019, on-balance-sheet cash.

First Published: Feb 7, 2020 2:16 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

'Borrowed' leaders: Congress hits out at AAP for not fielding their own candidates in Punjab

Apr 28, 2024 9:53 PM

EC asks AAP to modify election campaign song and Kejriwal's party is miffed

Apr 28, 2024 9:25 PM