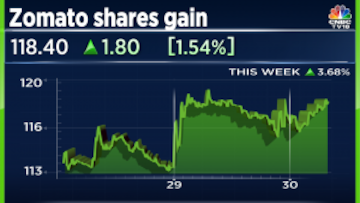

Shares of online food delivery giant Zomato Ltd will be in focus in Thursday's trade as global brokerage firm Citi remains bullish on the counter with a 'Buy' rating and a target price of ₹145, implying about 25% upside from the current market levels. At 11:55 am, the scrip was trading 1.46% higher at ₹118.30 apiece on the NSE.

The

Zomato stock has corrected approximately 7% since the conclusion of the World Cup. According to Citi, the stock correction could be due to media reports about non-payment of

GST on the delivery fee collected by the platform from consumers. The new GST would add

₹5 per order to non-Zomato Gold orders and may further support the adoption of Gold programme loyalty, the foreign brokerage said.

Global brokerage UBS has increased its target price on the stock to ₹150 per share from ₹125, citing a near 500 basis points improvement in the food delivery margins and 860 basis points improvement in overall margins between FY23 to FY26.

Domestic brokerage house Kotak Institutional Equities in a note said that Zomato's introduction of Zomato Gold was with the intent of retaining and gaining market share in the food delivery business and the loyalty program has aided its gross merchandise value (GMV) growth.

"The Blinkit and Instamart businesses seem to be similar in terms of GMV," Kotak said, retaining its target of ₹130 on the counter and a buy rating.

Recently, Netherlands-based Prosus Ventures, an investor in Swiggy, has disclosed data points on Swiggy's operating performance for the first six months of the year (H1CY23).

Prosus disclosed that Swiggy's core food delivery business GMV came in at $1.43 billion, up 17% year-on-year, and its Instamart business GMV increased 63% on-year in H1CY23. Overall, Swiggy’s combined GMV grew 28% YoY in H1CY23.

In comparison, Zomato posted H1CY23 food delivery GMV of $1.7 billion, up 13% YoY. This suggests GMV share of 54:46 in favor of Zomato, Kotak said. However, compared with Calender Year 2022, Swiggy seems to have gained some share, it noted.

'Zomato > Swiggy in execution'

While Swiggy’s gains are commendable, Zomato continued to be the dominant player with 54.0% relative market share, said JM Financial in a note. "Further, the latter's share loss during this period could be partly attributable to a few business decisions such as temporary suspension of its loyalty membership programme and shutdown of operations in 225 cities."

The brokerage added the recent results suggest Swiggy's gains in the food delivery vertical were partly attributable to Zomato's diversion in focus towards profitability. "These trends may not be sustainable in the long run, as at some point of time Swiggy too aspires to become a listed entity, in which case it would have to demonstrate significant improvement in profitability."

Moreover, it said that Swiggy, on a consolidated basis, has been reporting significantly higher absolute losses. This led the brokerage believe that Zomato has been far superior in execution as compared to Swiggy.